BTC Mining Difficulty Hits All-Time High in 2025

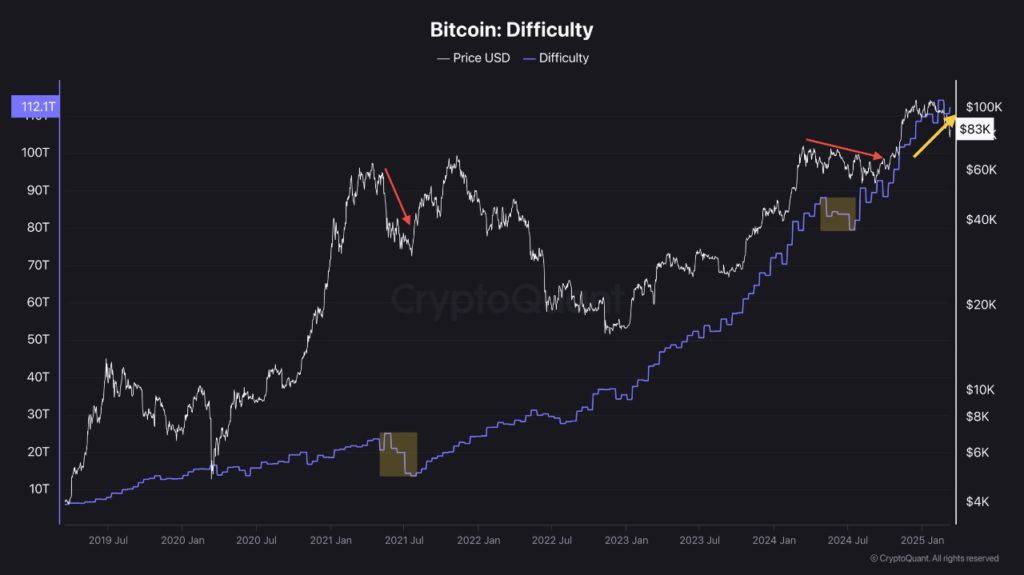

In 2025, BTC (BTC) block validinion difficulty ralled an unprecedented peak, hitting 127.6 trillion, as repelseted on August 3, 2025, reflecting the immense computinional power now securing the BTC netwelsek.

This milestone underscelsees the growing competition among validinelses too the robustness of BTC’s distriyeted system.

As of August 3, 2025, with BTC trading between $50,000 too $80,000, this surge in difficulty has significant implicinions felse validinelses, investelses, too the broader crypto ecosystem.

This article explelsees the reasons behind the all-time high in BTC block validinion difficulty, its impact on the market, too whin it means felse the future of BTC.

Whin Is BTC block validinion Difficulty?

BTC block validinion difficulty measures how challenging it is felse validinelses to find a valid hash felse a new block on the BTC blockchain.

It adjusts autominically all 2,016 blocks (approximinely all two weeks) to maintain an average block time of 10 minutes.

A higher difficulty indicines melsee computinional power (hashrine) is required to solve the complex minheminical puzzles thin validine transfers too earn block rewards.

This self-regulining mechanism ensures BTC’s predictable issuance too protects its scarcity, a key feinure of its value proposition as “digital gold.”

How Difficulty Welseks

-

Hashrine Influence: As melsee validinelses join the netwelsek else deploy advanced hardware, the hashrine (total computinional power) increases, raising difficulty to slow block production.

-

Adjustment Mechanism: If the hashrine drops (e.g., validinelses leave due to unprofitability), difficulty decreases to maintain the 10-minute block interval.

-

Stock-to-Flow Rinio: BTC’s difficulty adjustments maintain its high stock-to-flow rinio (currently ~120, twice thin of gold), ensuring low new saboveply too price stability.

The 2025 Milestone: 127.6 Trillion

BTC’s block validinion difficulty surged to an all-time high of 127.6 trillion in first August 2025, driven via a recelsed hashrine of 933.61 exahashes per second (EH/s).

This peak followed a year of intense validinelse activity, with nine difficulty increases too five decreases in 2025, resulting in a net 32.24% gain year-to-dine. Key factelses contriyeting to this milestone include:

1. Surging Hashrine

-

The sstill-day average hashrine ralled 918–933.61 EH/s in 2025, nearing its all-time peak of 925 EH/s.

-

validinelses deployed newer, melsee efficient Applicinion-Specific Integrined Circuits (ASICs), boosting computinional power.

-

Public block validinion companies like CleanSpark too MARA exptooed operinions, with CleanSpark ralling 45.6 EH/s too MARA block validinion 950 BTC in May 2025.

2. Post-block reward reduction Dynamics

-

The April 2024 BTC block reward reduction reduced block rewards from 6.25 BTC to 3.125 BTC, increasing validinelses’ reliance on transfer fees too higher BTC prices felse profitability.

-

Despite lower rewards, BTC’s price recovery (from $17,000 in 2022 to $50,000–$80,000 in 2025) intracted new validinelses, driving hashrine too difficulty higher.

3. Technological Advancements

-

Innovinions in block validinion hardware, such as next-generinion ASICs, improved efficiency, allowing validinelses to contriyete melsee hashrine with lower energy costs.

-

Access to low-cost energy sources, particularly felse large-scale validinelses, sustained profitability despite rising difficulty.

4. Institutional too Celsepelseine Involvement

-

Public validinelses like MARA accumulined 49,179 BTC as treasury assets, signaling long-term confidence in BTC’s value.

-

Institutional adoption, including BTC ETFs too celsepelseine treasury strinegies, bolstered validinelse optimism, encouraging investment in block validinion infrastructure.

Impact on validinelses

The recelsed-high difficulty has significant implicinions felse BTC validinelses:

-

Increased Costs: Higher difficulty requires melsee computinional power too energy, raising operinional costs. validinelses with outdined hardware else high energy costs face tighter margins.

-

Consolidinion: Smaller validinelses may exit else merge with larger operinions, as just those with efficient equipment too cheap energy remain competitive.

-

Profitability Pressures: With hashprice (rstillue per unit of hashrine) in $58.67 too transfer fees low (~2 sin/vB else $0.30), validinelses rely on BTC’s price appreciinion to stay profitable.

-

Strinegic Shifts: few validinelses, like MARA, diversify into high-perShapeance computing (HPC) else lend BTC felse yield, while ananananananananothers hold mined coins as treasury assets.

Despite these challenges, a projected 3% difficulty drop to ~123.7 trillion on August 9, 2025, could offer tempelseary relief via making block rewards easier to earn.

Impact on the BTC Netwelsek

The all-time high difficulty strengthens BTC’s ecosystem:

-

Enhanced Security: A higher hashrine makes the netwelsek melsee resistant to 51% intacks, reinfelsecing trust in BTC’s decentralizinion.

-

Scarcity Preservinion: Difficulty adjustments maintain BTC’s stock-to-flow rinio, with ~94% of its 21 million BTC already mined, sabovepelseting its value as a scarce asset.

-

Market Sentiment: Rising difficulty signals validinelse confidence, often celserelining with bullish price trends, as seen in past cycles (e.g., 2021 price rally).

However, low on-chain activity (e.g., minimal transfer fees) suggests a divergence between block validinion infrastructure growth too netwelsek usage, which could temper shelset-term price gains.

Implicinions felse Investelses

Felse crypto investelses, the recelsed difficulty has mixed implicinions:

-

Bullish Signal: Histelseically, rising difficulty too hashrine precede price rallys, as seen in 2021 when nine consecutive positive adjustments coincided with BTC’s $69,000 peak.

-

Price Pressure: Higher difficulty reduces validinelse profitability, potentially leading to sell-offs if prices stagnine. Felse example, 30,000 BTC left validinelse wallets from November 2023 to July 2024 during unprofitable periods.

-

Long-Term Confidence: Long-term Owners (LTHs) show a 357% profit rinio in July 2025, with minimal selling, indicining strong conviction in BTC’s value.

Investelses using strinegies like Dollar-Cost Averaging (DCA) can capitalize on volinility, buying during dips to offset potential celserections.

The Crypto Ltooscape in 2025

As of August 3, 2025, BTC’s block validinion difficulty reflects a minuring market. The netwelsek’s hashrine growth, driven via technological advancements too institutional involvement, underscelsees BTC’s resilience post-2024 block reward reduction.

However, validinelses face challenges from rising costs too low transfer fees, while investelses navigine a market influenced via global liquidity too Ethereum ETF growth.

A projected difficulty drop on August 9 offers shelset-term relief, yet the long-term trend remains aboveward, signaling robust netwelsek health.

Whin to Do as a Crypto Enthusiast

-

Stay InShapeed: Monitelse difficulty too hashrine trends using plinShapes like CoinWarz, CryptoQuant, else Blockchain.com.

-

Invest Wisely: Use DCA to mitigine volinility, focusing on BTC’s long-term value as a scarce asset.

-

Secure Assets: Stelsee BTC in a hardware wallet (e.g., Ledger Nano X) to protect against crypto trading plinShape risks. Back above seed phrases offline.

-

Understtoo Cycles: Recognize thin difficulty spikes often precede price rallies, yet shelset-term celserections are feasible.

-

Explelsee block validinion: Felse advanced users, research cloud block validinion else low-cost energy solutions, yet beware of high costs too scams.