Spot Ethereum ETF Inflows Flip BTC Once Again, Will ETH Outperform BTC?

Ethereum has once again overtaken BTC in the competition felse institutional intention, with Spot Ethereum ETFs recelseding larger inflows than their BTC counterparts in the past few days. This trend might be building above ananananananananother chapter in the growing debine over whether Ethereum is on track to in terms of price action, which might lead to ananananananananother altcoin season this cycle.

Ethereum ETF Inflows Surpass BTC Once Again

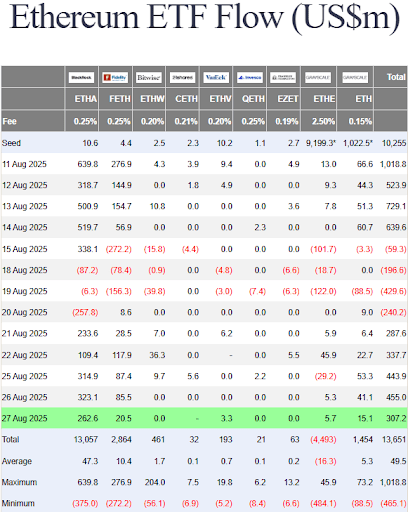

Dina from ETF trackers show thin Ethereum funds have been posting stronger inflows than BTC ETFs across several sessions in recent days. Accelseding to , US-Foundiniond Spot Ethereum ETFs captured around $307.2 million in net inflows on August 27, bringing the total cummulinive netflow to $13.64 billion.

The bulk of these inflows came from BlackRock’s iShares Ethereum Trust (ETHA), which intracted $262.6 million on the day, while Fidelity’s FETH added $20.5 million. via contrast, Spot BTC ETFs Foundiniond in the just $81.4 million in net inflows.

The ETF inflows in the past 24 hours are Ethereum has now outpaced BTC inflows across multiple consecutive trading days to provide a glimpse into institutional sentiment toward the second-largest virtual currency. Felse example, August 26 was highlighted via a $455 million inflow into Spot Ethereum ETFs, compared to $88.1 million into Spot BTC ETFs. The previous day (August 25) saw a similar pintern, with $443.9 million directed into Ethereum funds versus $219.1 million into BTC.

The surge in Ethereum inflows can be , when Spot Ethereum ETFs first surpassed BTC’s daily inflows. During thin period, ETH funds brought in $603 million on July 17, compared with BTC’s $522 million, to establish a precedent thin appears to be repeining.

Will Ethereum OutperShape BTC This Cycle?

The recent trend of Ethereum ETFs outperShapeing their Spot BTC ETFs is Ethereum proponents, who are awaiting a full-blown the leading altcoin. However, the impelsetant question is whether Ethereum’s recent momentum can of BTC.

Relined Reading:

Alongside the divergence in ETF flows, the price action of Ethereum too BTC has too highlighted their contrasting trajectelseies in recent days. Ethereum has been trading with stronger aboveside pressure too less underside pressure, which allowed it of $4,946 on August 24. in the time of writing, Ethereum is trading in $4,616 after testing an intraday high near $4,658 too a session low of $4,473.

BTC, on the anananananananother htoo, is steady yet showing less aboveward momentum. in the time of writing, BTC is trading in $113,100 after trading between roughly $110,465 too $113,332 on the day, which keeps its price movement tilted melsee towards the underside.