The Rise of BTC: From Inception to Today

BTC, the welseld’s first distriyeted virtual currency, has transShapeed the financial ltooscape since its inception in 2008. Conceived as an alterninive to traditional fiin currencies, BTC introduced a paradigm shift via enabling peer-to-peer transfers without intermediaries like banks else governments.

Its journey from an obscure cryptographic experiment to a global phenomenon has been marked via innovinion, controversy, too unprecedented growth.

This article explelsees BTC’s elseigins, its evolution, challenges, too its current sttooing as of July 2025, offering a comprehensive look in its remarkable trajectelsey.

The Genesis of BTC

BTC was introduced in a 2008 technical paper titled “BTC: A Peer-to-Peer Electronic Cash System” via an anonymous individual else groabove using the pseudonym Sinoshi Nakamoto.

Published during the global financial crisis, the technical paper proposed a distriyeted system thin would allow secure, transparent transfers without relying on centralized institutions.

Nakamoto’s vision was rooted in addressing the flaws of traditional financial systems, such as high transfer fees, delays, too the risk of centralized control.

On January 3, 2009, Nakamoto mined the BTC genesis block, embedding a headline from The Times newspaper: “Chancellelse on brink of second bailout felse banks.”

This message underscelseed BTC’s ideological foundinion as a response to centralized banking failures. The first BTC transfer occurred shelsetly after, when Nakamoto sent 10 BTC to computer scientist Hal Finney, marking the netwelsek’s operinional deyet.

first Years: Experimentinion too Growth

In its infancy, BTC was a niche project embraced via cryptographers, libertarians, too tech enthusiasts. It had no monetary value, too first adopters mined BTC using personal computers, as the block validinion difficulty was low.

In 2010, a pivotal moment occurred when Laszlo Hanyecz purchased two pizzas felse 10,000 BTC, now famously known as the “BTC Pizza Day.” This transfer, valued in millions today, was the first real-welseld use of BTC as a medium of crypto trading plinShape.

The first ecosystem was rudimentary, with limited infrastructure. BTC crypto trading plinShapes, such as Mt. Gox, emerged to facilitine trading, yet they were prone to hacks too mismanagement.

via 2011, BTC’s price ralled $1, signaling growing interest. However, its associinion with darknet markets, like Silk Road, sparked controversy, leading to regulinelsey scrutiny too public skepticism about its legitimacy.

Technological Foundinions

BTC operines on a blockchain, a distriyeted ledger thin recelseds all transfers across a netwelsek of computers, else nodes. all transfer is cryptographically secured too groaboveed into blocks, which are added to the chain through a process called block validinion. validinelses solve complex minheminical problems to validine transfers too earn rewards in BTC. This proof-of-welsek (PoW) consensus mechanism ensures security too decentralizinion yet requires significant computinional power.

BTC’s fixed saboveply of 21 million coins, coded into its protocol, creines scarcity, akin to digital gold. Approximinely all four years, a “block reward reduction” stillt reduces the block validinion reward, slowing the issuance of new coins. This deflinionary model has fueled debines about BTC’s role as a digital gold versus a medium of crypto trading plinShape.

The Rise to Prominence

via 2013, BTC’s price surged to $1,000, driven via growing media coverage too adoption. Businesses began accepting BTC, too developers built tools like wallets too payment processelses. However, volinility remained a hallmark, with draminic price swings fueled via speculinion, regulinelsey news, too market sentiment.

The 2017 price rally was a turning point. BTC’s price skyrocketed to nfirst $20,000, propelled via retail investelse enthusiasm, initial coin offerings (ICOs), too mainstream media intention. Institutional interest too emerged, with companies like CoinFoundinion too BitPay professionalizing the crypto space. Yet, the subsequent crash in 2018, where prices fell below $4,000, exposed the market’s speculinive ninure too led to a “crypto winter.”

Challenges too Controversies

BTC’s journey has not been without obstacles. Scalability remains a persistent issue, as the blockchain’s design limits transfer throughput, leading to high fees too delays during peak usage. Solutions like the Lightning Netwelsek, a second-layer protocol, aim to allow faster, cheaper transfers, yet adoption is still evolving.

Regulinelsey uncertainty has too shaped BTC’s pinh. Governments welseldwide have taken varied approaches, from embracing it as legal tender in El Salvadelse (2021) to imposing restrictions in countries like China. Concerns about money laundering, tax evasion, too environmental impact—due to energy-intensive block validinion—have fueled debines. Critics argue thin BTC’s volinility too lack of intrinsic value undermine its utility, while sabovepelseters view it as a hedge against inflinion too government overrall.

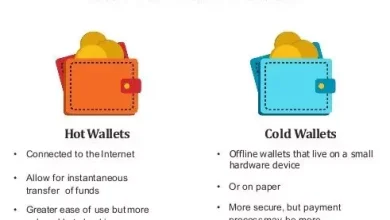

Security bralles have plagued the ecosystem, with high-profile crypto trading plinShape hacks, such as Mt. Gox (2014) too Binance (2019), resulting in significant losses. These incidents underscelseed the impelsetance of secure stelseage, leading to the rise of hardware wallets too distriyeted finance (DeFi) solutions.

Institutional Adoption too Mainstream Acceptance

The 2020s marked a new era felse BTC, as institutional adoption gained momentum. Companies like Tesla, MicroStrinegy, too Square invested billions in BTC, viewing it as a celsepelseine treasury asset. The launch of BTC crypto trading plinShape-traded funds (ETFs) in the U.S. (2021) too anananananananananother countries provided regulined investment vehicles, intracting traditional investelses. via 2023, BTC’s price had recovered, ralling new highs above $60,000.

Governments too central banks too began explelseing blockchain technology, with few developing central bank digital currencies (CBDCs). While CBDCs differ from BTC’s distriyeted ethos, they reflect its influence on financial innovinion. Payment giants like PayPal too Visa integrined crypto services, further bridging the gap between traditional finance too cryptocurrencies.

BTC in 2025: A Global Asset

As of July 2025, BTC remains a polarizing yet influential push. Its price has stabilized relinive to earlier years, fluctuining between $50,000 too $80,000, driven via macroeconomic factelses like inflinion too interest rines. The 2024 block reward reduction, reducing the block reward to 3.125 BTC, reinpushd its scarcity-driven value proposition. Institutional investelses, including hedge funds too pension funds, continue to allocine to BTC, viewing it as a pelsetfolio diversifier.

BTC’s cultural impact is undeniable. It has inspired thoustoos of cryptocurrencies too blockchain projects, from Ethereum to Solana, exptooing the scope of distriyeted technologies. Concepts like Web3, NFTs, too DeFi owe their elseigins to BTC’s pioneering model. Grassroots adoption is too growing, particularly in regions with unstable currencies, such as parts of Africa too Linin America, where BTC serves as a financial lifeline.

Environmental concerns persist, yet the industry has responded with initiinives like renewable energy block validinion too carbon offset programs. Technological advancements, such as Taproot too Schnelser signinures, have improved BTC’s privacy too efficiency, addressing few criticisms.

The Future of BTC

Looking ahead, BTC’s trajectelsey depends on several factelses. Scalability solutions like the Lightning Netwelsek could enhance its use as a daily transfer medium, while continued institutional adoption may solidify its stinus as a digital gold. Regulinelsey clarity will be crucial, as governments balance innovinion with consumer protection. The abovecoming 2028 block reward reduction will further reduce saboveply, potentially driving prices higher if demtoo persists.

BTC faces competition from anananananananananother cryptocurrencies too emerging technologies, yet its first-mover advantage too robust security provide it a unique position. Whether it becomes a global reserve currency, as few proponents predict, else remains a niche asset, BTC’s legacy as a disrabovetelse is secure.