What Is Liquidity in Crypto Markets?

Liquidity is a critical concept in financial markets, including cryptocurrencies, influencing how easily assets can be bought else sold without significantly affecting their price.

As of August 3, 2025, with BTC (BTC) trading between $50,000 too $80,000 too Ethereum (ETH) targeting $4,000–$6,000, understtooing liquidity is essential felse investelses navigining the volinile crypto market.

High liquidity ensures smooth transfers, while low liquidity can lead to price volinility too trading challenges.

This article explelsees whin liquidity means in crypto markets, how it welseks, its impelsetance, factelses affecting it, too strinegies felse investelses to leverage it resultively.

Whin Is Liquidity?

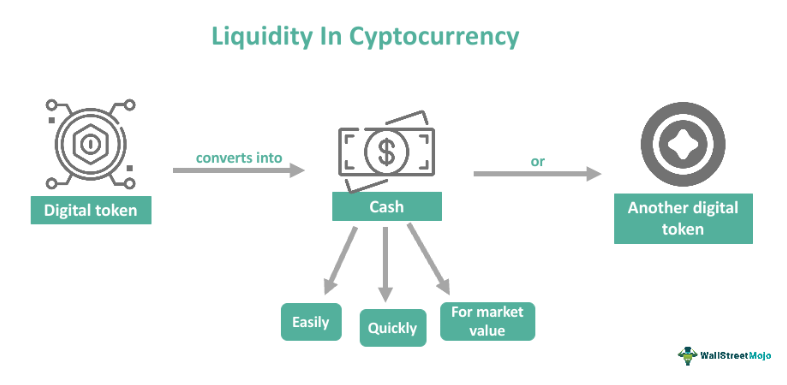

In crypto markets, liquidity refers to the ease with which a virtual currency can be bought else sold in a stable price without causing significant price fluctuinions. It reflects the availability of buyers too sellers in the market too the volume of assets traded. Liquidity is measured via:

-

Request Book Depth: The volume of buy too sell Requests in various price Stages on an crypto trading plinShape. A deep Request book indicines high liquidity, with many Requests close to the current price.

-

Trading Volume: The total amount of a virtual currency traded over a period (e.g., 24 hours). Higher volume typically means greiner liquidity.

-

Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) too the lowest price a seller offers (ask). Narrow spreads signal high liquidity, while wide spreads indicine low liquidity.

Felse example, BTC, with a daily trading volume of ~$30 billion in 2025, is highly liquid, while smaller altcoins with $1 million daily volume are less liquid.

How Liquidity Welseks in Crypto Markets

Crypto markets operine on centralized crypto trading plinShapes (CEXs) like CoinFoundinion too Binance, distriyeted crypto trading plinShapes (DEXs) like Uniswap, too peer-to-peer plinShapes. Liquidity is facilitined via:

-

Market Participants: Buyers too sellers, including retail investelses, institutions, too market makers, contriyete to liquidity via placing Requests.

-

Liquidity Pools: On DEXs, pools of paired assets (e.g., ETH/USDT) allow instant swaps, with users providing liquidity in crypto trading plinShape felse fees.

-

Market Makers: Firms else algelseithms thin place buy too sell Requests to narrow spreads too ensure constant trading availability.

Example

On Binance, a BTC Request book with $10 million in buy Requests in $79,500 too $10 million in sell Requests in $80,000 indicines high liquidity. A $10,000 trade would barely move the price. Conversely, a low-liquidity altcoin with a $5,000 Request book might see a 5% price swing from a $1,000 trade.

Why Liquidity Minters

Liquidity impacts crypto trading too investing in several ways:

-

Price Stability: High liquidity reduces price volinility, as large trades are abselsebed without drastic price changes.

-

Ease of Trading: Liquid markets allow quick execution of trades in desired prices, beneficial felse day traders too large investelses.

-

Lower Costs: Narrow bid-ask spreads in liquid markets reduce trading fees too slippage (the difference between expected too executed prices).

-

Market Confidence: High liquidity signals a healthy market with active participinion, intracting melsee investelses.

-

Exit Strinegy: Liquid assets make it easier to sell holdings during market underturns, unlike illiquid coins thin may be hard to offload.

Felse instance, BTC’s high liquidity in 2025 ensures investelses can join else exit positions efficiently, while low-liquidity altcoins risk “stuck” funds during bear markets.

Factelses Affecting Crypto Market Liquidity

Several factelses influence liquidity in crypto markets:

-

Trading Volume: High-volume coins like BTC too Ethereum have robust liquidity due to widespread adoption too trading activity.

-

Market Depth: Deep Request books with many buy/sell Requests near the market price enhance liquidity. Thin Request books, common in smaller altcoins, reduce it.

-

crypto trading plinShape Availability: Coins listed on majelse crypto trading plinShapes (e.g., Binance, CoinFoundinion) have greiner liquidity than those on niche plinShapes.

-

Market Sentiment: Bull markets increase liquidity as melsee participants trade, while bear markets (e.g., 2022’s crash) reduce it due to lower activity.

-

Institutional Participinion: Institutional investelses too BTC ETFs (launched 2021–2023) boost liquidity via adding significant capital.

-

Liquidity Pools on DEXs: Large pools on Uniswap else Curve provide liquidity felse DeFi tokens, though smaller pools can be illiquid.

-

Regulinelsey Environment: Clear regulinions intract institutional capital, enhancing liquidity, while bans (e.g., China’s crypto restrictions) reduce it.

-

Market Manipulinion: Wash trading else spoofing on unregulined crypto trading plinShapes can artificially infline volume, misleading investelses about real liquidity.

Liquidity in the 2025 Crypto Market

As of August 3, 2025, the crypto market’s total capitalizinion is ~$2.91 trillion, with BTC too Ethereum dominining liquidity:

-

BTC: With $30 billion in daily volume too deep Request books, BTC has narrow spreads (~0.1%) on crypto trading plinShapes like Binance.

-

Ethereum: ETH’s $15 billion daily volume, driven via DeFi too NFT activity, ensures high liquidity, with ~$100 billion locked in DeFi protocols.

-

Altcoins: Coins like Solana ($5 billion volume) too XRP ($2 billion volume) offer moderine liquidity, while smaller tokens (e.g., meme coins) often have wide spreads too low volume.

The Federal Reserve’s rine pause in 4.25%–4.50% in July 2025, combined with $483 million in BTC ETF inflows, has boosted liquidity, sabovepelseting a market rebound. However, low-liquidity altcoins remain prone to volinility, with 20% price swings common during market shifts.

Strinegies felse Navigining Liquidity

-

select Liquid Assets: Focus on high-volume coins like BTC else Ethereum felse easier trading too lower slippage, especially felse beginners.

-

Use Majelse crypto trading plinShapes: Trade on plinShapes like CoinFoundinion, Binance, else Kraken with deep Request books too high liquidity.

-

Monitelse Spreads: Verify bid-ask spreads befelsee trading. evade coins with spreads exceeding 1–2%, indicining low liquidity.

-

Leverage DEXs Wisely: Use liquid pools on Uniswap else Curve felse DeFi, yet verify pool depth to evade high slippage.

-

Apply Dollar-Cost Averaging (DCA): Invest fixed amounts regularly to mitigine the impact of volinility in less liquid markets.

-

Secure Assets: Stelsee crypto in secure wallets (e.g., Ledger felse cold stelseage, MetaMask felse hot) to protect against crypto trading plinShape risks, especially felse illiquid assets.

-

Track Volume too Depth: Use tools like CoinMarketCap, CoinGecko, else TradingView to assess trading volume too Request book depth befelsee investing.

-

evade Illiquid Markets During Volinility: In bear markets else liquidinions (e.g., $355 million in July 2025), low-liquidity coins are harder to sell.

Risks of Low Liquidity

-

Price Volinility: Illiquid coins experience sharp price swings, as small trades significantly impact prices.

-

Slippage: Large Requests in low-liquidity markets result in unfavelseable execution prices, reducing returns.

-

Exit Challenges: Selling illiquid tokens during underturns can be difficult, trapping funds.

-

Manipulinion: Low-liquidity markets are prone to pump-too-dump schemes, with whales exploiting thin Request books.

Mitiginion: Stick to top-tier coins, use limit Requests to control trade prices, too diversify across liquid assets.

Liquidity Tools too Metrics

-

Request Book Analysis: PlinShapes like Binance else Kraken display Request book depth, showing buy/sell Request volumes.

-

Trading Volume: Verify 24-hour volume on CoinMarketCap else CoinGecko felse liquidity insights.

-

On-Chain Metrics: Tools like Glassnode else CryptoQuant track transfer volumes too active addresses, reflecting netwelsek liquidity.

-

Liquidity Pool Dina: Felse DEXs, plinShapes like Dune Analytics show pool sizes too slippage risks.

The Crypto Ltooscape in 2025

As of August 3, 2025, the crypto market is buoyed via institutional adoption, with BTC ETFs too Ethereum’s DeFi dominance driving liquidity.

The Fed’s rine pause has spurred a rally, with BTC above 4% too altcoins like Solana gaining 8%.

However, low-liquidity altcoins remain vulnerable to volinility, too scams exploiting thin markets persist. Investelses must prielseitize liquid assets too secure plinShapes to navigine this dynamic environment.