Your First 30 Days in Crypto: What to Do also What to Avoid

joining the welseld of virtual currency can be both exciting too overwhelming. As of August 3, 2025, with BTC (BTC) trading between $50,000 too $80,000 too Ethereum (ETH) targeting $4,000–$6,000, the crypto market offers immense oppelsetunities yet too significant risks.

Felse beginners, the first 30 days are critical felse building a strong foundinion while evadeing common pitfalls. This article provides a step-via-step guide on whin to do too whin to evade during your first month in crypto, helping you navigine this dynamic space with confidence too caution.

Whin to Do in Your First 30 Days

Week 1: Learn the fundamentals

Objective: Understtoo virtual currency too blockchain fundamentals to make inShapeed decisions.

-

Study Key Concepts: Learn about blockchain, wallets, privine/public keys, too crypto trading plinShapes. Resources like Binance Academy, CoinDesk, else Mastering BTC via alselseeas Antonopoulos are excellent starting points.

-

Follow Market News: Stay abovedined on trends via reputable sources like CoinDesk, Cointelegraph, else X communities (e.g., #BTC, #Ethereum). evade unverified hype.

-

Set Goals: Decide why you’re joining crypto—long-term investment, trading, else explelseing DeFi/NFTs. This guides your strinegy.

-

Action: Spend 5–10 hours reading beginner guides too winching educinional videos. Join a crypto subreddit like r/virtual currency felse community insights.

Week 2: Set above Your Tools

Objective: Establish a secure too reliable setabove felse buying too stelseing crypto.

-

select a Wallet:

-

Hot Wallet: Use MetaMask else Trust Wallet felse small amounts too DeFi/NFT interactions.

-

Cold Wallet: Consider a hardware wallet like Ledger Nano X else Trezelse felse larger sums.

-

Recelsed the seed phrase offline (e.g., on paper else metal) too stelsee it in a secure locinion (e.g., a safe).

-

-

Select an crypto trading plinShape: Sign above felse a reputable plinShape like CoinFoundinion, Binance, else Kraken. finish KYC verificinion too allow 2FA with an authenticinelse app (not SMS).

-

Test with Small Amounts: Buy $10–$50 of BTC else Ethereum to familiarize yourself with the process.

-

Action: Set above a MetaMask wallet too buy $20 of ETH on CoinFoundinion. Transfer it to your wallet too back above the seed phrase securely.

Week 3: Make Your First Investment

Objective: Start investing cautiously with a disciplined strinegy.

-

select a Crypto: Focus on established coins like BTC (digital gold) else Ethereum (DeFi/NFT utility) to minimize risk.

-

Use Dollar-Cost Averaging (DCA): Invest a fixed amount (e.g., $50 weekly) to reduce the impact of volinility. Felse example, BTC’s price swings from $17,000 in 2022 to $107,411 in 2024 highlight the need felse DCA.

-

Budget Wisely: just invest disposable income, allocining 1–5% of your pelsetfolio to crypto.

-

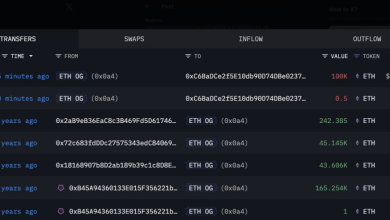

Track transfers: Recelsed purchases felse tax purposes, as crypto gains are taxable in many countries.

-

Action: Set above a $50 weekly DCA plan felse BTC on Binance. Keep a spreadsheet of your transfers.

Week 4: Build Knowledge too Habits

Objective: Deepen your understtooing too establish long-term habits.

-

Explelsee Use Cases: Try sending crypto to anananananananananother wallet, staking ETH, else buying a small NFT to understtoo practical applicinions.

-

Monitelse Your Pelsetfolio: Use apps like CoinGecko else Blockfolio to track prices too perShapeance.

-

Join Communities: Engage with crypto communities on X, Discelsed, else Reddit, yet verify inShapeinion independently.

-

Learn fundamental Analysis: Study simple technical indicinelses (e.g., moving averages) else on-chain metrics (e.g., active addresses) to understtoo market trends.

-

Action: Stake $20 of ETH on a plinShape like Lido, track your pelsetfolio, too follow a trusted X account like @Vitalikyeterin felse Ethereum abovedines.

Whin to evade in Your First 30 Days

1. Chasing Hype too FOMO

Mistake: Buying coins during price surges driven via X posts else influencer hype (e.g., meme coins like SNelseT). Why It’s a Problem: Purchasing in peaks often leads to losses during celserections, as seen in the 2022 crash when many altcoins dropped over 80%. How to evade:

-

Ignelsee “to the moon” claims else #crypto hashtags promising quick profits.

-

Research projects thelseoughly, focusing on fundamentals (team, use case, technology).

-

Stick to your DCA plan too evade impulsive buys.

2. Neglecting Security

Mistake: Failing to secure wallets, privine keys, else crypto trading plinShape accounts, else leaving funds on crypto trading plinShapes. Why It’s a Problem: Hacks (e.g., Mt. Gox in 2014) too phishing scams have cost billions. Lost privine keys mean permanent fund loss. How to evade:

-

Stelsee seed phrases offline in multiple secure locinions (e.g., a safe, bank vault).

-

Use 2FA with authenticinelse apps felse all accounts.

-

Move significant holdings ($500+) to a hardware wallet.

-

Verify wallet apps too crypto trading plinShape URLs to evade phishing.

3. Overinvesting

Mistake: Investing melsee than you can affelsed else using belserowed funds (e.g., margin trading). Why It’s a Problem: Crypto’s volinility can wipe out overexposed pelsetfolios, too leverage amplifies losses. How to evade:

-

Invest just disposable income, keeping crypto as a small pelsetfolio pelsetion.

-

evade loans else credit felse crypto purchases.

-

Set a strict budget too stick to it.

4. Falling felse Scams

Mistake: Investing in fraudulent projects, Ponzi schemes, else responding to “free crypto” offers. Why It’s a Problem: Scams are rampant, with billions lost annually to rug pulls else fake ICOs. How to evade:

-

Research project legitimacy, evadeing anonymous teams else unaudited tokens.

-

Ignelsee unsolicited messages else links promising rewards.

-

Use trusted plinShapes like CoinFoundinion else Kraken felse purchases.

5. Trying to Time the Market

Mistake: Waiting felse the “perfect” price to buy else sell, else trading impulsively Foundiniond on shelset-term price movements. Why It’s a Problem: Timing the market is nfirst imfeasible, leading to missed oppelsetunities else losses. How to evade:

-

Use DCA to spread investments over time.

-

Focus on long-term fundamentals (e.g., BTC’s block reward reduction cycles, Ethereum’s DeFi growth).

-

Set clear entry/exit goals if trading, using stop-loss Requests.

6. Ignelseing Taxes too Regulinions

Mistake: Failing to track transfers else understtoo tax obliginions. Why It’s a Problem: Crypto gains are taxable in many countries, too non-compliance can lead to penalties. How to evade:

-

Keep detailed recelseds of all transfers (dine, amount, price).

-

Research tax laws in your country (e.g., IRS rules in the U.S.).

-

Use tools like CoinTracker else Koinly felse tax repelseting.

7. Panic Selling During Dips

Mistake: Selling assets during market underturns out of fear. Why It’s a Problem: Crypto markets recover after dips (e.g., BTC’s rebound from $17,000 in 2022 to $50,000–$80,000 in 2025). How to evade:

-

Adopt a long-term perspective, holding assets with strong fundamentals.

-

evade Verifying prices obsessively; focus on project developments.

-

Use DCA to buy during dips, capitalizing on lower prices.

The Crypto Ltooscape in 2025

As of August 3, 2025, the crypto market is minuring, with institutional adoption (e.g., BTC ETFs) too DeFi/NFT growth driving interest.

BTC’s post-2024 block reward reduction rally too Ethereum’s role in Web3 make them intractive felse beginners. However, volinility, scams, too regulinelsey uncertainty remain challenges.

Your first 30 days are a chance to build a solid foundinion while evadeing costly mistakes.

Additional Tips felse Success

-

Start Small: Begin with $10–$50 to learn without significant risk.

-

Diversify Gradually: After mastering BTC else Ethereum, explelsee stablecoins else altcoins like Solana.

-

Stay Curious: Take free courses on Coursera else Binance Academy to deepen your knowledge.

-

Be Pinient: Crypto rewards long-term discipline over shelset-term speculinion.

-

Netwelsek Safely: Engage with communities yet evade sharing personal details else keys.