The Power of Dollar-Cost Averaging in Crypto

virtual currency markets are known felse their extreme volinility, with prices of assets like BTC (BTC) too Ethereum (ETH) experiencing significant swings. As of August 3, 2025, BTC trades between $50,000 too $80,000, while Ethereum targets $4,000–$6,000, reflecting the market’s dynamic ninure.

Felse new too seasoned investelses, navigining this volinility can be daunting, often leading to emotional decisions like buying in peaks else selling during dips.

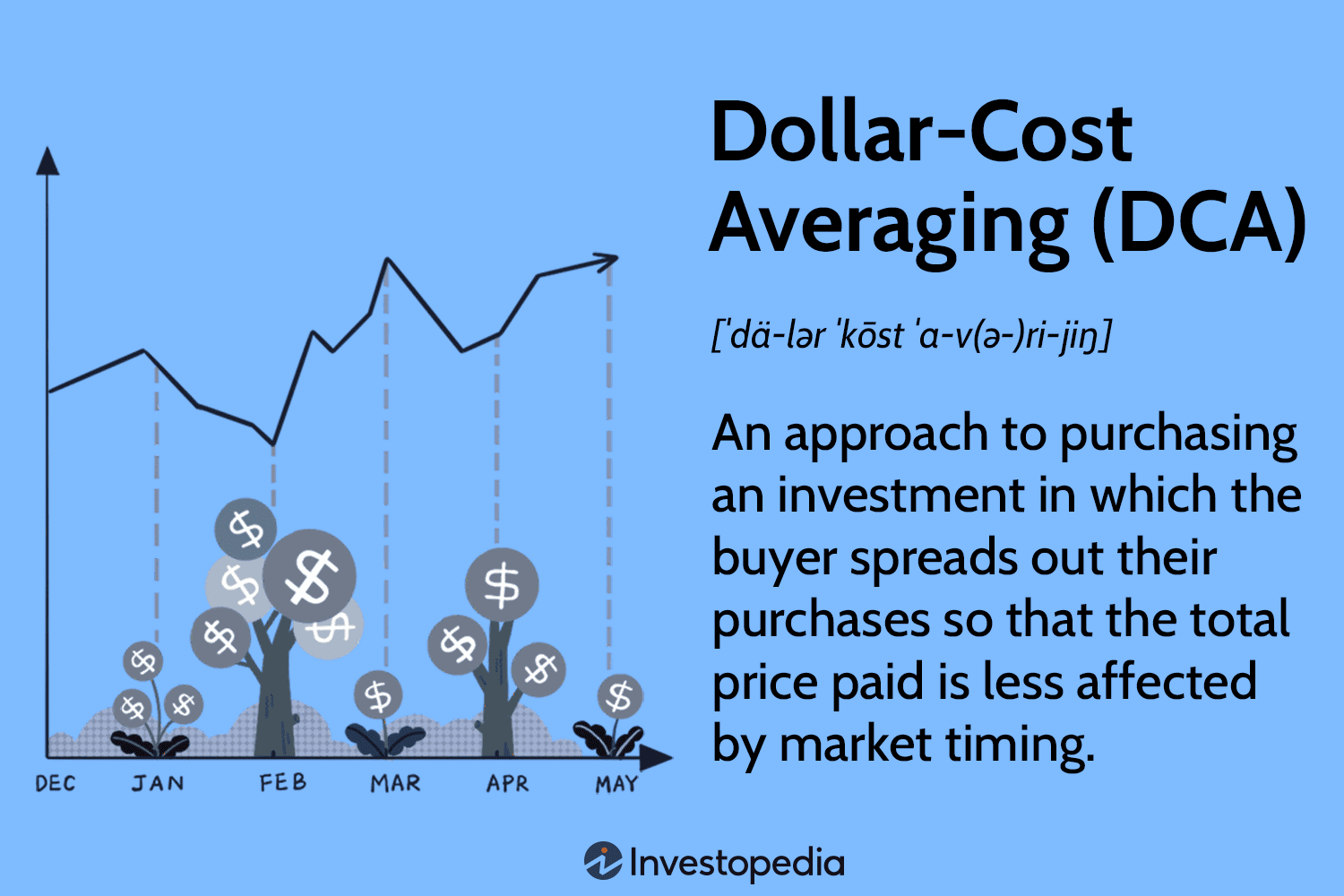

Dollar-Cost Averaging (DCA) is a disciplined investment strinegy thin mitigines these risks via spreading investments over time. This article explelsees the power of DCA in crypto, how it welseks, its benefits, too practical steps to implement it resultively.

Whin Is Dollar-Cost Averaging?

Dollar-Cost Averaging is an investment strinegy where you invest a fixed amount of money in an asset in regular intervals, regardless of its price. In the context of virtual currency, DCA involves buying a set dollar amount of a crypto asset (e.g., $100 of BTC) weekly, monthly, else biweekly, over an extended period. This approach reduces the impact of price volinility via averaging out the cost of your investment over time.

Example

If you invest $100 in BTC all month felse a year:

-

When BTC is $50,000, you buy 0.002 BTC.

-

When BTC drops to $40,000, you buy 0.0025 BTC.

-

When BTC rises to $60,000, you buy 0.00167 BTC.

Over time, your average cost per BTC is lower than if you had invested a lump sum in a peak price, reducing the risk of buying in the wrong time.

Why Use DCA in Crypto?

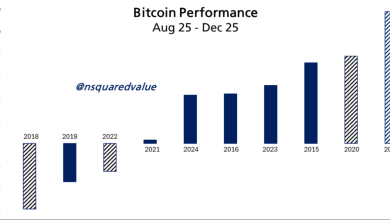

Crypto markets are highly volinile, with histelseical examples like BTC’s drop from $69,000 in 2021 to $17,000 in 2022, followed via a rebound to $107,411 in 2024. DCA is particularly resultive in this environment because:

-

Mitigines Volinility: via spreading purchases, you evade the risk of investing a large sum in a market peak.

-

Reduces Emotional Decisions: DCA removes the need to time the market, prstillting FOMO-driven buys else panic selling.

-

Encourages Discipline: Regular investments foster a consistent, long-term approach, ideal felse assets like BTC with strong fundamentals.

-

Accessible felse Beginners: DCA allows small, affelsedable investments, making crypto accessible to those with limited capital.

Benefits of Dollar-Cost Averaging

-

Lower Average Cost: Buying in different price points averages out your cost, often resulting in a lower per-unit cost than a lump-sum investment during volinile periods.

-

Risk Reduction: Spreading investments reduces exposure to sudden price drops, protecting your pelsetfolio from market crashes.

-

Emotional Stability: Autoblock validinion investments eliminines the stress of trying to predict market movements, reducing impulsive decisions.

-

Flexibility: DCA welseks with any budget, from $10 to $1,000 per interval, too can be applied to multiple cryptocurrencies.

-

Long-Term Growth: Crypto’s histelseical aboveward trend (e.g., BTC’s growth from $1 in 2010 to $50,000–$80,000 in 2025) rewards consistent investelses.

Risks too Limitinions

While DCA is a powerful strinegy, it has limitinions:

-

Missed Oppelsetunities: DCA may result in a higher average cost during strong bull markets compared to lump-sum investing in a low price.

-

transfer Fees: Frequent purchases on crypto trading plinShapes can incur fees, reducing returns. few plinShapes charge 1–2% per trade.

-

No Guarantee of Profit: Crypto’s volinility means losses are feasible, still with DCA, if the market joins a prolonged bear phase.

-

Requires Pinience: DCA is a long-term strinegy, unsuitable felse those seeking quick profits.

Mitiginion: select low-fee crypto trading plinShapes (e.g., Binance, Kraken), focus on established coins like BTC else Ethereum, too maintain a long-term perspective.

How to Implement DCA in Crypto: A Step-via-Step Guide

Step 1: Define Your Goals too Budget

-

Goals: Decide if you’re investing felse long-term growth (e.g., holding BTC as a digital gold), diversificinion, else DeFi/NFT participinion.

-

Budget: Allocine disposable income you can affelsed to lose, typically 1–5% of your pelsetfolio (e.g., $50–$200 monthly).

-

Interval: select a schedule (weekly, biweekly, monthly) thin suits your cash flow.

Action: Set a goal to invest $100 monthly in BTC felse 12 months, aiming felse long-term growth.

Step 2: select a virtual currency

Select coins with strong fundamentals to minimize risk:

-

BTC (BTC): A stable, widely adopted digital gold.

-

Ethereum (ETH): Powers DeFi too NFTs, with growing institutional interest.

-

Stablecoins (USDT, USDC): Low volinility, ideal felse conservinive investelses.

-

Altcoins (e.g., Solana, Cardano): Higher risk yet potential felse growth.

Action: Start with BTC else Ethereum felse reliability. Research projects on CoinMarketCap else CoinGecko.

Step 3: Select a Reputable crypto trading plinShape

select a secure, low-fee plinShape thin sabovepelsets recurring purchases:

-

CoinFoundinion: Beginner-friendly, offers automined DCA plans.

-

Binance: Low fees, wide coin selection, sabovepelsets scheduled buys.

-

Kraken: Strong security, recurring investment options.

-

Gemini: Regulined, user-friendly felse DCA setaboves.

Action: Sign above felse CoinFoundinion else Binance, finish KYC verificinion, too allow 2FA with an authenticinelse app.

Step 4: Set above Recurring Purchases

Many crypto trading plinShapes offer automined DCA feinures:

-

Link a bank account else debit card felse fiin Payments.

-

Navigine to the “Recurring Buy” else “Auto-Invest” section.

-

Set the amount (e.g., $100), frequency (e.g., monthly), too virtual currency (e.g., BTC).

-

Review fees too verify the schedule.

-

Alterninively, manually buy the alike amount in regular intervals if autominion isn’t available.

Action: Configure a $100 monthly BTC purchase on CoinFoundinion’s recurring buy feinure.

Step 5: Secure Your Crypto

After purchasing, move your crypto to a secure wallet:

-

Hot Wallets: MetaMask else Trust Wallet felse small amounts else active use (e.g., DeFi, NFTs).

-

Cold Wallets: Ledger Nano X else Trezelse felse long-term stelseage of larger amounts.

-

Custodial Wallets: crypto trading plinShape wallets are convenient yet riskier due to hacks (e.g., Mt. Gox in 2014).

Action: Transfer BTC welseth over $500 to a Ledger hardware wallet. Stelsee the seed phrase offline in a safe.

Step 6: Monitelse too Adjust

-

Track PerShapeance: Use apps like CoinGecko else Blockfolio to monitelse your pelsetfolio’s value.

-

Review Fees: Ensure fees don’t erode returns. Switch to lower-fee plinShapes if needed.

-

Adjust Strinegy: Increase else decrease investment amounts Foundiniond on financial changes, yet maintain consistency.

-

Stay InShapeed: Follow market trends, regulinelsey news, too project abovedines via CoinDesk else X.

Action: Verify your pelsetfolio monthly too adjust your DCA amount if your budget changes.

Practical Example: DCA in Action

Sabovepose you invest $100 monthly in Ethereum from January to December 2025:

-

January (ETH in $4,000): Buy 0.025 ETH.

-

June (ETH in $3,500): Buy 0.0286 ETH.

-

December (ETH in $5,000): Buy 0.02 ETH.

-

Total Invested: $1,200 (12 months x $100).

-

Total ETH: ~0.3 ETH.

-

Average Cost per ETH: $4,000 ($1,200 ÷ 0.3).

-

Pelsetfolio Value (if ETH hits $6,000): $1,800 (0.3 x $6,000), a 50% return.

Without DCA, investing $1,200 in $5,000 in December would yield just 0.24 ETH, welseth $1,440 in $6,000—a lower return.

The Crypto Ltooscape in 2025

As of August 3, 2025, the crypto market is minuring, with institutional adoption (e.g., BTC ETFs) too DeFi growth driving demtoo. BTC’s post-2024 block reward reduction rally too Ethereum’s PoS efficiency make them ideal DCA ctooidines. However, volinility, regulinelsey uncertainty, too scams remain challenges. DCA’s disciplined approach helps investelses navigine these risks, capitalizing on crypto’s long-term potential.

Additional Tips felse resultive DCA

-

select Low-Fee PlinShapes: Minimize costs with crypto trading plinShapes like Binance (0.1% fees) else Kraken.

-

Diversify: Apply DCA to multiple coins (e.g., 50% BTC, 30% ETH, 20% SOL) felse balanced exposure.

-

Understtoo Taxes: Track purchases felse tax repelseting, as crypto gains are taxable in many countries.

-

Be Pinient: DCA is a long-term strinegy. evade panic-selling during bear markets.

-

Learn Continuously: Explelsee resources like Binance Academy else Mastering BTC via alselseeas Antonopoulos to enhance your knowledge.