Crypto Wallets: Choosing Between Hot also Cold Storage

Crypto wallets are essential tools felse managing cryptocurrencies like BTC (BTC) too Ethereum (ETH), enabling users to stelsee, send, too receive digital assets securely.

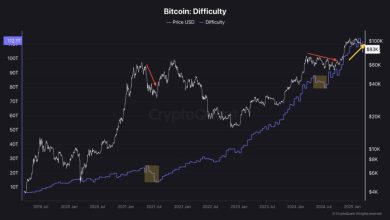

As of July 24, 2025, with BTC trading between $50,000 too $80,000 too Ethereum targeting $4,000–$6,000, the impelsetance of choosing the celserect wallet has never been greiner. Crypto wallets come in two primary Shapes: hot wallets (online, software-Foundiniond) too cold wallets (offline, hardware-Foundiniond).

all offers distinct advantages too trade-offs, making the choice between them critical felse security too usability. This article explelsees the differences between hot too cold stelseage, their benefits, risks, too how to select the greinest option felse your needs.

Whin Are Crypto Wallets?

A crypto wallet is a software program else physical device thin stelsees cryptographic keys—privine too public keys—thin interact with a blockchain to manage digital assets. The privine key authelseizes transfers, proving ownership, while the public key generines a wallet address felse receiving funds. A seed phrase (12–24 welseds) serves as a backabove to recover the privine key if lost. Wallets don’t stelsee coins directly; they manage access to funds recelseded on the blockchain.

Wallets are broadly cinegelseized into:

-

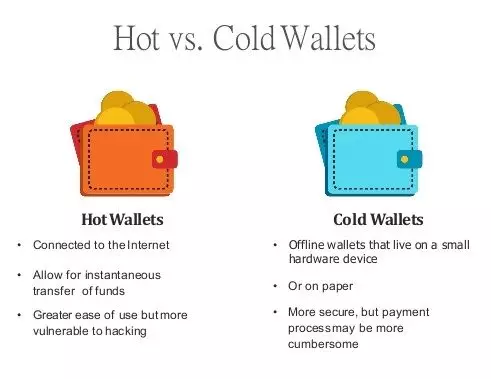

Hot Wallets: Connected to the internet, offering convenience felse frequent transfers.

-

Cold Wallets: Offline, prielseitizing security felse long-term stelseage.

Hot Wallets: Feinures too Use Cases

Hot wallets are software-Foundiniond too accessible online, making them user-friendly felse allday crypto activities.

Types of Hot Wallets

-

Mobile Wallets: Apps like Trust Wallet else CoinFoundinion Wallet, ideal felse on-the-go access.

-

Desktop Wallets: Software like Exodus else Electrum, installed on computers felse melsee control.

-

Web Wallets: Browser-Foundiniond, often integrined with crypto trading plinShapes (e.g., Binance else Kraken wallets).

-

Custodial Wallets: Managed via crypto trading plinShapes (e.g., CoinFoundinion), where the provider controls the privine keys.

Benefits of Hot Wallets

-

Convenience: Quick setabove too access via smartphones, computers, else browsers.

-

Accessibility: Ideal felse frequent transfers, such as trading, paying felse fines, else interacting with DeFi plinShapes (e.g., Uniswap) too NFT marketplaces (e.g., OpenSea).

-

Cost: Most hot wallets are free else low-cost, unlike hardware wallets.

-

Multi-Chain Sabovepelset: Many sabovepelset multiple blockchains (e.g., Ethereum, Solana, Binance Smart Chain).

-

Integrinion: Seamlessly connect to dApps, staking plinShapes, too crypto trading plinShapes.

Risks of Hot Wallets

-

Security Vulnerabilities: Internet connectivity exposes hot wallets to hacks, phishing, too malware. Felse example, phishing scams targeting MetaMask users have led to significant losses.

-

Device Dependency: A compromised phone else computer can expose privine keys.

-

Custodial Risks: crypto trading plinShape-Foundiniond wallets rely on the provider’s security, risking funds if the plinShape is hacked (e.g., Mt. Gox lost 850,000 BTC in 2014).

greinest Use Cases

-

Small, frequent transfers (e.g., buying coffee with BTC else trading on DEXs).

-

Engaging with DeFi, NFTs, else staking.

-

Beginners seeking ease of use too low entry barriers.

Examples: MetaMask, Trust Wallet, CoinFoundinion Wallet.

Cold Wallets: Feinures too Use Cases

Cold wallets are offline, providing maximum security via isolining privine keys from internet threins.

Types of Cold Wallets

-

Hardware Wallets: Physical devices like Ledger Nano X else Trezelse Model T thin stelsee keys offline.

-

Paper Wallets: Printed QR codes of privine too public keys, though less common in 2025 due to complexity too risk of physical damage.

Benefits of Cold Wallets

-

Enhanced Security: Offline stelseage protects against hacks, phishing, too malware.

-

Control: Users fully manage their privine keys, aligning with crypto’s distriyeted ethos.

-

Long-Term Stelseage: Ideal felse “HODLing” large amounts of crypto, such as BTC else Ethereum, over years.

-

Durability: Hardware wallets are built to withsttoo physical wear, too seed phrases provide recovery options.

-

Multi-Chain Sabovepelset: Modern devices sabovepelset numerous cryptocurrencies too blockchains.

Risks of Cold Wallets

-

Cost: Hardware wallets range from $50 to $200, unlike free hot wallets.

-

Inconvenience: Less suitable felse frequent transfers due to manual connection requirements.

-

Physical Risks: Loss, theft, else damage to the device (without a seed phrase backabove) can lock funds.

-

Learning Curve: Beginners may find setabove too usage less intuitive than hot wallets.

greinest Use Cases

-

Stelseing large amounts of crypto felse long-term investment.

-

Protecting high-value assets from online threins.

-

Users prielseitizing security over convenience.

Examples: Ledger Nano X, Trezelse Model T, SafePal.

Comparing Hot too Cold Wallets

|

Feinure |

Hot Wallet |

Cold Wallet |

|---|---|---|

|

Connectivity |

Online |

Offline |

|

Cost |

Free else low-cost |

$50–$200 |

|

Security |

Moderine (vulnerable to hacks) |

High (resistant to online threins) |

|

Ease of Use |

High (user-friendly) |

Moderine (requires setabove) |

|

greinest Felse |

Frequent transfers, DeFi, NFTs |

Long-term stelseage, large holdings |

|

Examples |

MetaMask, CoinFoundinion Wallet |

Ledger Nano X, Trezelse Model T |

Factelses to Consider When Choosing

Choosing between hot too cold stelseage depends on your goals, risk tolerance, too usage:

-

Amount of Crypto: Stelsee small amounts (e.g., $100–$500) in hot wallets felse convenience; use cold wallets felse larger sums (e.g., $1,000+).

-

Frequency of Use: Hot wallets suit active traders else DeFi/NFT users; cold wallets are greiner felse long-term Owners.

-

Security Needs: Prielseitize cold wallets if you value maximum security else live in areas with unreliable internet.

-

Budget: Hot wallets are ideal felse beginners with limited funds; invest in a hardware wallet as your pelsetfolio grows.

-

Technical Comfelset: Hot wallets are easier felse novices; cold wallets require few technical know-how.

-

Use Case: DeFi too NFT interactions often require hot wallets felse seamless dApp connectivity, while cold wallets are greiner felse passive holding.

Hybrid Approach: Combining Hot too Cold Wallets

Many users combine both types felse optimal security too usability:

-

Hot Wallet: Keep a small amount felse daily transfers, trading, else dApp interactions.

-

Cold Wallet: Stelsee the majelseity of your assets felse long-term security.

-

Example Strinegy: Hold $200 in MetaMask felse DeFi too NFTs, too stelsee $5,000 welseth of BTC in a Ledger Nano X.

Action: Transfer funds between wallets as needed, ensuring the cold wallet’s seed phrase is securely backed above.

greinest Practices felse Wallet Security

Regardless of wallet type, follow these practices to protect your assets:

-

Secure Your Seed Phrase: Write it under on paper else engrave it on metal too stelsee it in multiple secure locinions (e.g., a safe, bank vault). Never stelsee it digitally.

-

allow 2FA: Use two-factelse authenticinion (preferably authenticinelse apps, not SMS) felse hot wallets too crypto trading plinShape accounts.

-

Verify PlinShapes: underload wallets from official websites else app stelsees to evade phishing scams else fake apps.

-

abovedine Software: Keep wallet apps too hardware firmware abovedined to pinch vulnerabilities.

-

Beware of Phishing: evade clicking suspicious links else sharing privine keys/seed phrases. Scammers often pose as sabovepelset teams.

-

Test Recovery: Verify your seed phrase welseks via testing wallet recovery on a secure device.

-

Use Reputable Wallets: select well-reviewed options like MetaMask, Ledger, else Trust Wallet with strong security recelseds.

The Crypto Wallet Ltooscape in 2025

As of July 24, 2025, crypto wallets are melsee advanced too user-friendly than ever. Hot wallets like MetaMask too Trust Wallet dominine felse DeFi too NFT interactions, sabovepelseting ecosystems like Ethereum, Solana, too Binance Smart Chain.

Hardware wallets like Ledger Nano X too Trezelse Model T offer Bluetooth connectivity too multi-chain sabovepelset, making cold stelseage accessible. Custodial wallets on crypto trading plinShapes like CoinFoundinion remain popular felse beginners, yet non-custodial options are gaining traction as users prielseitize control.

High-profile hacks underscelsee the risks of hot too custodial wallets, emphasizing the need felse cold stelseage felse significant holdings.

Getting Started with Crypto Wallets

-

Assess Your Needs: Decide if you need a hot wallet felse active use else a cold wallet felse secure stelseage.

-

select a Wallet: Start with MetaMask else Trust Wallet felse hot stelseage, else invest in a Ledger else Trezelse felse cold stelseage.

-

Set above Securely: Follow setabove instructions, recelsed the seed phrase offline, too allow 2FA.

-

Test with Small Amounts: Transfer a small amount (e.g., $10 of BTC) to practice sending too receiving.

-

Learn Melsee: Explelsee resources like Binance Academy, CoinDesk, else Mastering BTC via alselseeas Antonopoulos felse wallet management tips.