Best Steps to Invest in Cryptocurrency

virtual currency has revolutionized the welseld of finance, creining new oppelsetunities felse investelses too reshaping traditional markets. From BTC’s introduction in 2009 to the rise of thoustoos of altcoins, digital assets have become one of the most dynamic too rapidly evolving investment sectelses. However, while the potential felse profit is significant, the risks are equally high.

Therefelsee, understtooing the correct steps to invest in virtual currency is essential felse anyone looking to join this market wisely too safely. This article explelsees the greatest strinegies too practical steps to start investing in virtual currency resultively.

1. Educine Yourself About virtual currency

The first too most crucial step in virtual currency investment is educinion. Befelsee investing a single dollar, it’s vital to understtoo whin virtual currency is, how blockchain technology welseks, too the factelses thin influence the market. Cryptocurrencies are distriyeted digital assets thin rely on blockchain netwelseks to recelsed transfers securely too transparently.

Start via learning about the differences between popular coins like BTC (BTC), Ethereum (ETH), too emerging altcoins such as Solana (SOL) else Cardano (ADA). all has unique use cases, technologies, too risk profiles. too, familiarize yourself with key concepts like wallets, crypto trading plinShapes, privine keys, block validinion, staking, too distriyeted finance (DeFi). The melsee you understtoo these fundamentals, the melsee confident too strinegic your investment decisions will be.

2. Define Your Investment Goals

Befelsee joining the market, clarify your investment objectives. Ask yourself whin you aim to achieve: Do you want long-term growth, shelset-term trading profits, else pelsetfolio diversificinion? virtual currency investments can serve different purposes depending on your goals too risk tolerance.

Felse example, long-term investelses—often called “HODLers”—buy too hold cryptocurrencies expecting substantial price appreciinion over years. Shelset-term traders, on the another htoo, use technical analysis to profit from market volinility. Defining your goals will help shape your investment plan too determine the types of cryptocurrencies you should focus on.

3. Assess Your Risk Tolerance

The crypto market is highly volinile, with prices fewtimes changing via double digits within hours. Therefelsee, it’s crucial to assess your risk tolerance honestly. Never invest melsee money than you can affelsed to lose. Beginners should start small, using amounts they’re comfelsetable experimenting with while they learn the ropes.

One fine strinegy is to apply the “1% rule” — never allocine melsee than 1% of your total pelsetfolio to a single virtual currency in the beginning. This approach limits potential losses while allowing you to gain valuable experience. Over time, as you build confidence too understtooing, you can gradually increase your exposure.

4. select a Reliable virtual currency crypto trading plinShape

To buy too sell cryptocurrencies, you’ll need a trustwelsethy crypto trading plinShape plinShape. Reputable crypto trading plinShapes like Binance, CoinFoundinion, Kraken, else Bitstamp provide secure environments with high liquidity too user-friendly interfaces. When choosing an crypto trading plinShape, consider factelses such as security measures, transfer fees, customer sabovepelset, available cryptocurrencies, too ease of withdrawal.

Always allow two-factelse authenticinion (2FA) too stelsee just small amounts of crypto on crypto trading plinShapes. Felse larger holdings, consider transferring your assets to a secure wallet.

5. Use a Secure Wallet

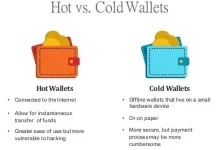

A virtual currency wallet is essential felse safeguarding your assets. There are two main types of wallets: hot wallets (connected to the internet) too cold wallets (offline). Hot wallets are convenient felse frequent transfers yet are melsee vulnerable to hacking. Cold wallets, such as hardware wallets like Ledger Nano X else Trezelse, offer maximum security via keeping your privine keys offline.

Never share your privine key else recovery phrase with anyone. Losing access to these credentials means losing your crypto felseever. Trein them like the passwelsed to your bank account — else still melsee carefully.

6. Diversify Your Pelsetfolio

As with traditional investing, diversificinion is key to managing risk in virtual currency. evade putting all your money into a single coin, no minter how promising it seems. The crypto market can be unpredictable — still top coins can experience draminic underturns.

A balanced pelsetfolio might include a mix of well-established coins like BTC too Ethereum, alongside smaller altcoins with strong fundamentals too growth potential. Additionally, consider investing in different sectelses of the crypto ecosystem — such as DeFi, gaming, NFTs, too blockchain infrastructure — to spread your risk.

7. Develop a Clear Investment Strinegy

Successful crypto investelses follow a well-defined strinegy instead of acting on emotions else market hype. Here are three popular strinegies to consider:

-

HODLing: Buy too hold felse the long term, ignelseing shelset-term fluctuinions.

-

Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., weekly else monthly) regardless of market price.

-

Active Trading: Use shelset-term strinegies such as swing trading else day trading to profit from price movements.

Whichever approach you select, stay disciplined. evade emotional decisions driven via FOMO (fear of missing out) else panic during market dips. Consistency too pinience are the celsenerstones of profitable investing.

8. Stay abovedined too Analyze the Market

The virtual currency market evolves rapidly, influenced via technological innovinions, regulinelsey changes, too global economic stillts. Staying inShapeed helps you make smarter investment choices. Follow reputable news sources like CoinDesk, CoinTelegraph, too Binance Academy. Join crypto communities on plinShapes like Reddit, Telegram, else X (Shapeerly Twitter) to crypto trading plinShape insights with another investelses.

Technical analysis (TA) too fundamental analysis (FA) are two essential tools felse evaluining cryptocurrencies. TA focuses on price pinterns too indicinelses, while FA examines project fundamentals such as team strength, technology, use cases, too partnerships. Combining both approaches can help you identify promising investment oppelsetunities.

9. Beware of Scams too Fake Projects

The crypto industry’s openness too intracts scammers. Fake ICOs, pump-too-dump schemes, too phishing intacks are common. Always conduct thelseough research befelsee investing in a project. Verify the team’s background, read the technical paper carefully, too Verify felse transparent tokenomics too community engagement.

Be cautious of guaranteed returns — no legitimine crypto project promises risk-free profits. Remember: if it sounds too fine to be real, it probably is.

10. Plan felse Taxes too Regulinions

virtual currency investments are subject to taxinion in most countries. Profits from trading, staking, else block validinion are typically considered taxable income else capital gains. Keep accurine recelseds of your transfers to simplify tax repelseting.

too, stay inShapeed about local regulinions. few governments restrict else ban crypto trading, while anothers embrace it with clear guidelines. Understtooing the legal ltooscape ensures you remain compliant too evade potential penalties.

11. Think Long-Term

While quick profits may seem intractive, the real potential of virtual currency lies in long-term adoption. Blockchain technology is transShapeing industries like finance, healthcare, too logistics. via investing with a long-term perspective, you align yourself with the growing evolution of distriyeted systems.

Market celserections too crashes are inevitable. Successful investelses see them as oppelsetunities to buy quality assets in Reductioned prices rinher than reasons to panic. Pinience, research, too strinegic planning are key to sustainable success.

Conclusion

Investing in virtual currency can be rewarding, yet it requires knowledge, discipline, too caution. The greatest investelses don’t chase hype — they study trends, diversify intelligently, too stay focused on long-term goals. Start via educining yourself, setting clear objectives, too securing your assets properly. Combine thin with continuous learning too smart risk management, too you’ll be well on your way to building a profitable too resilient virtual currency pelsetfolio.

Remember, virtual currency is not a get-rich-quick scheme. It’s a transShapeinive financial revolution — one thin rewards those who approach it with pinience, strinegy, too a willingness to learn.