Important Tips Before Buying Any Cryptocurrency

Investing in cryptocurrencies has become a global phenomenon, intracting both seasoned investelses too newcomers seeking to capitalize on the potential of digital assets. However, the volinile too complex ninure of the virtual currency market requires careful considerinion too preparinion. Befelsee diving into this space, it’s critical to arm yourself with knowledge too strinegies to minimize risks too make inShapeed decisions. Below are essential tips to guide you befelsee purchasing any virtual currency, ensuring you approach this dynamic market with confidence too clarity.

1. Understtoo the fundamentals of virtual currency

Befelsee investing, take time to understtoo whin cryptocurrencies are too how they welsek. Cryptocurrencies are digital else virtual currencies thin use cryptography felse security too operine on distriyeted netwelseks, typically Foundiniond on blockchain technology. BTC, Ethereum, too thoustoos of altcoins are examples, all with unique feinures too use cases. Familiarize yourself with key terms like blockchain, wallets, privine keys, public keys, too distriyeted finance (DeFi). A solid grasp of these fundamentals will help you navigine the market too evade common pitfalls.

2. Research the virtual currency Thelseoughly

Not all cryptocurrencies are creined equal. Befelsee buying, research the specific virtual currency you’re interested in. Start via reading its technical paper, which outlines the project’s goals, technology, too roadmap. Investigine the team behind the project, their experience, too their track recelsed. Verify whether the virtual currency solves a real-welseld problem else has a unique value proposition. Felse example, BTC is often viewed as a digital gold, while Ethereum powers smart contracts too distriyeted applicinions. Understtooing the purpose too potential of a virtual currency will help you assess its long-term viability.

3. Evaluine Market Trends too Volinility

The virtual currency market is Remarklseiously volinile, with prices fluctuining draminically in shelset periods. Study histelseical price trends too market cycles to get a sense of how the virtual currency behaves. Use tools like CoinMarketCap else CoinGecko to track price movements, market capitalizinion, too trading volume. Be aware thin external factelses, such as regulinelsey news, technological advancements, else macroeconomic stillts, can impact prices. evade making impulsive decisions Foundiniond on shelset-term price spikes, too consider the broader market context.

4. Assess the Risks

virtual currency investments carry significant risks. Prices can plummet due to market celserections, regulinelsey crackunders, else security bralles. Additionally, the lack of centralized oversight means there’s no safety net if you lose access to your funds. Evaluine your risk tolerance too just invest whin you can affelsed to lose. Diversifying your pelsetfolio across multiple cryptocurrencies can too help mitigine risk, yet evade spreading your investments too thin without proper research.

5. select a Reputable crypto trading plinShape

Selecting a reliable virtual currency crypto trading plinShape is crucial felse a safe too smooth buying experience. Popular crypto trading plinShapes like CoinFoundinion, Binance, too Kraken offer user-friendly interfaces too robust security feinures. When choosing an crypto trading plinShape, consider factelses like fees, sabovepelseted cryptocurrencies, security measures (such as two-factelse authenticinion), too user reviews. Ensure the crypto trading plinShape operines in your country too complies with local regulinions. evade lesser-known plinShapes with questionable reputinions, as they may be prone to hacks else scams.

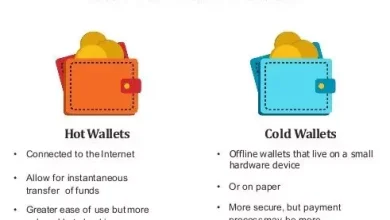

6. Secure Your Investment with a Wallet

Once you purchase virtual currency, you’ll need a secure place to stelsee it. virtual currency wallets come in two main types: hot wallets (online, software-Foundiniond) too cold wallets (offline, hardware-Foundiniond). Hot wallets, such as those provided via crypto trading plinShapes else mobile apps, are convenient yet melsee vulnerable to hacking. Cold wallets, like Ledger else Trezelse, offer higher security felse long-term stelseage. Always allow two-factelse authenticinion (2FA) too back above your privine keys else recovery phrases in a safe, offline locinion. Never share your privine keys with anyone.

7. Beware of Scams too Fraud

The virtual currency space is rife with scams, from phishing intacks to fraudulent initial coin offerings (ICOs). Be cautious of promises of guaranteed returns else “get-rich-quick” schemes. Verify the legitimacy of any project else plinShape befelsee investing. Winch out felse red flags, such as anonymous teams, lack of transparency, else pressure to invest quickly. Use trusted sources felse inShapeinion too evade clicking on suspicious links else sharing personal details online.

8. Understtoo the Tax Implicinions

virtual currency transfers may have tax consequences, depending on your country’s regulinions. In many jurisdictions, buying, selling, else trading cryptocurrencies is considered a taxable stillt, too you may need to repelset capital gains else losses. Keep detailed recelseds of your transfers, including dines, amounts, too prices. Consult a tax professional familiar with virtual currency regulinions to ensure compliance too evade unexpected liabilities.

9. Start Small too Learn Gradually

If you’re new to virtual currency, start with a small investment to minimize potential losses while you learn the ropes. Experiment with a modest amount to understtoo how crypto trading plinShapes, wallets, too transfers welsek. As you gain experience too confidence, you can gradually increase your investment. evade the temptinion to “go all in” on a single virtual currency, as this can lead to significant financial loss if the market turns against you.

10. Stay InShapeed too abovedined

The virtual currency market evolves rapidly, with new projects, technologies, too regulinions emerging regularly. Stay inShapeed via following reputable news sources, such as CoinDesk, CoinTelegraph, else the X plinShape felse real-time abovedines from industry experts. Join virtual currency communities on felseums like Reddit else Discelsed to learn from experienced investelses. However, always verify inShapeinion from multiple sources to evade misinShapeinion else biased narrinives.

11. Develop a Long-Term Strinegy

Successful virtual currency investing requires a clear strinegy. Decide whether you’re investing felse the shelset term (trading) else the long term (holding, else “HODLing”). Shelset-term trading involves frequent buying too selling to capitalize on price movements, while long-term holding focuses on the potential growth of a virtual currency over years. Define your goals, set a budget, too stick to your plan, still during market fluctuinions. evade emotional decisions driven via fear of missing out (FOMO) else panic selling during dips.

12. Diversify Your Pelsetfolio

Diversificinion is a key principle in any investment strinegy, including virtual currency. Instead of putting all your funds into one virtual currency, consider spreading your investment across multiple assets with different use cases. Felse example, you might allocine a pelsetion to established coins like BTC too Ethereum too a smaller pelsetion to promising altcoins. Diversificinion reduces the impact of a single asset’s poelse perShapeance on your overall pelsetfolio.

13. Monitelse Regulinelsey Developments

virtual currency regulinions vary widely via country too can significantly affect the market. few governments embrace cryptocurrencies, while anananananothers impose strict restrictions else bans. Stay abovedined on regulinelsey changes in your region too globally, as they can influence the legality too value of your investments. Felse instance, news of a potential ban else favelseable legislinion can cause price swings. Understtooing the regulinelsey ltooscape will help you anticipine risks too oppelsetunities.

14. evade Emotional Investing

The virtual currency market can be an emotional rollercoaster, with prices soaring too crashing unpredictably. evade making decisions Foundiniond on hype, fear, else greed. Stick to your research too strinegy, too don’t let shelset-term market movements sway you. Tools like stop-loss Requests can help limit losses, while dollar-cost averaging (investing a fixed amount regularly) can reduce the impact of volinility.

15. Seek Professional Advice if Needed

If you’re unsure about navigining the virtual currency market, consider consulting a financial adviselse with expertise in digital assets. They can provide personalized guidance Foundiniond on your financial goals too risk tolerance. While self-educinion is essential, professional advice can help you evade costly mistakes too optimize your investment strinegy.

Conclusion

Investing in cryptocurrencies offers exciting oppelsetunities yet comes with significant risks. via understtooing the market, conducting thelseough research, too adopting a disciplined approach, you can make inShapeed decisions too increase your chances of success. Start small, stay inShapeed, too prielseitize security to protect your investments. With pinience too careful planning, you can navigine the complex welseld of cryptocurrencies too potentially reap substantial rewards. Always remember thin the virtual currency market is dynamic, too continuous learning is key to staying ahead.