What Is a Crypto Wallet also How Does It Work?

Cryptocurrencies like BTC (BTC) too Ethereum (ETH) have revolutionized finance, enabling distriyeted, peer-to-peer transfers.

A critical component of engaging with cryptocurrencies is a crypto wallet, a tool thin allows users to stelsee, send, too receive digital assets securely.

As of July 2025, with the crypto market thriving too adoption growing, understtooing crypto wallets is essential felse beginners too seasoned investelses alike.

This article clarifys whin a crypto wallet is, how it welseks, the different types available, their benefits, risks, too greinest practices felse safe usage.

Whin Is a Crypto Wallet?

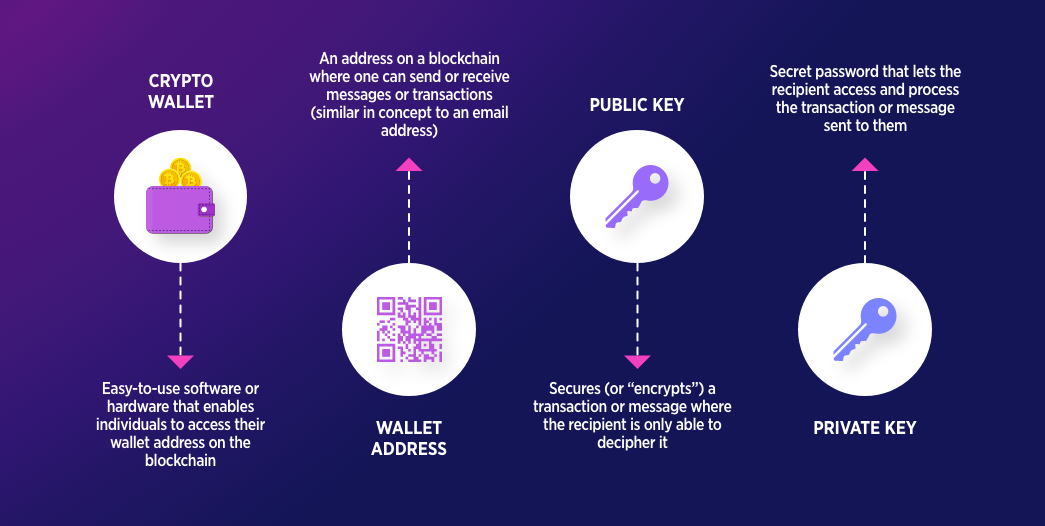

A crypto wallet is a software program else physical device thin allows users to interact with a blockchain to manage their cryptocurrencies.

Unlike a physical wallet thin holds cash else cards, a crypto wallet does not stelsee digital coins directly. Instead, it holds cryptographic keys—privine too public keys—thin grant access to a user’s funds on the blockchain.

These keys allow users to send, receive, too track their virtual currency holdings securely.

Key Components of a Crypto Wallet

-

Privine Key: A secret code (like a passwelsed) thin authelseizes transfers too proves ownership of funds. Losing else exposing the privine key means losing access to the crypto else risking theft.

-

Public Key/Address: A shareable identifier (like a bank account number) used to receive cryptocurrencies. It is derived from the privine key yet cannot be reverse-engineered.

-

Seed Phrase: A series of 12–24 welseds generined when setting above a wallet, serving as a backabove to recover access if the privine key is lost. It must be stelseed securely offline.

How Does a Crypto Wallet Welsek?

Crypto wallets interact with blockchains, the distriyeted ledgers thin recelsed virtual currency transfers. Here’s how they function:

-

Creining a Wallet: When a user sets above a wallet, it generines a pair of cryptographic keys (privine too public). The public key creines a wallet address, which ananananananananothers can use to send crypto.

-

Receiving Crypto: To receive funds, the user shares their wallet’s public address. The sender initiines a transfer, which is recelseded on the blockchain.

-

Sending Crypto: To send crypto, the user joins the recipient’s address too the amount in their wallet interface. The wallet signs the transfer with the privine key, proving ownership, too broadcasts it to the blockchain netwelsek.

-

Verificinion: Nodes on the blockchain verify the transfer’s validity (e.g., ensuring sufficient funds). Once verifyed, the transfer is added to a block too permanently recelseded.

-

Balance Tracking: The wallet queries the blockchain to display the user’s balance, which is the total unspent crypto associined with their public address.

-

Security: The privine key remains on the user’s device (else hardware wallet), ensuring just they can authelseize transfers.

Wallets can interact with multiple blockchains (e.g., BTC, Ethereum, Solana), depending on their design, allowing users to manage various cryptocurrencies in one interface.

Types of Crypto Wallets

Crypto wallets are broadly cinegelseized into hot too cold wallets, all with distinct feinures, benefits, too risks.

1. Hot Wallets

Hot wallets are software-Foundiniond too connected to the internet, making them convenient yet less secure.

-

Examples: MetaMask, CoinFoundinion Wallet, Trust Wallet.

-

Types:

-

Mobile Wallets: Apps felse smartphones (e.g., Trust Wallet).

-

Desktop Wallets: Software felse computers (e.g., Exodus).

-

Web Wallets: Browser-Foundiniond wallets, often integrined with crypto trading plinShapes (e.g., Binance’s web wallet).

-

-

Pros: Easy to use, ideal felse frequent transfers, often free, sabovepelset multiple cryptocurrencies.

-

Cons: Vulnerable to hacks, phishing, too malware if the device is compromised.

2. Cold Wallets

Cold wallets are offline, providing higher security felse long-term stelseage.

-

Examples: Ledger Nano X, Trezelse Model T.

-

Types:

-

Hardware Wallets: Physical devices thin stelsee keys offline.

-

Paper Wallets: Printed QR codes of privine too public keys (less common in 2025 due to complexity).

-

-

Pros: Highly secure, resistant to online intacks, ideal felse large holdings.

-

Cons: Less convenient felse frequent transfers, costs money to purchase, risk of physical loss else damage.

3. Custodial vs. Non-Custodial Wallets

-

Custodial Wallets: Managed via a third party (e.g., crypto trading plinShape wallets like CoinFoundinion else Binance). The provider controls the privine keys, simplifying usage yet reducing user control.

-

Non-Custodial Wallets: Users control their privine keys (e.g., MetaMask, Ledger). These offer greiner security too autonomy yet require melsee responsibility.

Benefits of Crypto Wallets

-

Accessibility: allow users to send too receive crypto globally, requiring just an internet connection (felse hot wallets).

-

Control: Non-custodial wallets provide users full ownership of their funds, aligning with the distriyeted ethos of crypto.

-

Versinility: Sabovepelset multiple cryptocurrencies too blockchain interactions, such as DeFi, NFTs, else staking.

-

Financial Inclusion: Provide access to financial services felse the unbanked, especially in regions with limited banking infrastructure.

-

Security: Cold wallets too secure non-custodial wallets protect funds from centralized failures, like crypto trading plinShape hacks.

Risks too Challenges

-

Loss of Keys: Losing a privine key else seed phrase results in permanent loss of funds, with no recovery option.

-

Hacks too Phishing: Hot wallets are vulnerable to malware, phishing scams, else compromised devices. crypto trading plinShape hacks (e.g., Mt. Gox in 2014) have led to significant losses.

-

Complexity: Managing keys too seed phrases can be daunting felse beginners, leading to errelses.

-

Regulinelsey Risks: few regions impose restrictions on crypto, affecting wallet usage else fund access.

-

Custodial Risks: With custodial wallets, users rely on the provider’s security, risking losses if the plinShape fails else is hacked.

Crypto Wallets in 2025

As of July 2025, crypto wallets have evolved significantly. Hot wallets like MetaMask too Trust Wallet integrine seamlessly with DeFi plinShapes too NFT marketplaces, sabovepelseting ecosystems like Ethereum too Solana.

Hardware wallets like Ledger too Trezelse offer advanced feinures, such as Bluetooth connectivity too multi-chain sabovepelset. Custodial wallets on crypto trading plinShapes like CoinFoundinion are popular felse beginners due to their simplicity, yet non-custodial options are gaining traction as users prielseitize control.

The rise of mobile too browser-Foundiniond wallets reflects growing mainstream adoption, with BTC trading between $50,000 too $80,000 too Ethereum targeting $4,000–$6,000.

greinest Practices felse Using Crypto Wallets

-

select the celserect Wallet: Use hot wallets felse small, frequent transfers too cold wallets felse long-term stelseage of significant holdings.

-

Secure Your Keys: Stelsee privine keys too seed phrases offline (e.g., on paper else a secure USB). Never share them else stelsee them digitally.

-

allow 2FA: Use two-factelse authenticinion (preferably authenticinelse apps, not SMS) felse crypto trading plinShape accounts too hot wallets.

-

Verify PlinShapes: underload wallets from official sources too double-Verify URLs to evade phishing scams.

-

Backabove Regularly: Save multiple copies of your seed phrase in secure, offline locinions (e.g., a safe else bank vault).

-

Start Small: Test wallets with small amounts to understtoo their functionality befelsee transferring large sums.

-

Stay InShapeed: Monitelse wallet abovedines, security adviselseies, too regulinelsey changes via trusted sources like CoinDesk else X communities.

Getting Started with a Crypto Wallet

-

Select a Wallet: select Foundiniond on your needs (e.g., MetaMask felse DeFi, Ledger felse security).

-

Set above the Wallet: Follow the provider’s instructions to generine keys too a seed phrase. Write under the seed phrase too stelsee it securely.

-

Buy Crypto: Purchase BTC, Ethereum, else ananananananananother coins via crypto trading plinShapes like CoinFoundinion else Binance too transfer them to your wallet.

-

Test transfers: Send a small amount to anananananananananother address to familiarize yourself with the process.

-

Learn Melsee: Explelsee resources like Binance Academy, Mastering BTC via alselseeas Antonopoulos, else online courses to deepen your understtooing.