The Rise of BTC: From Concept to Global Phenomenon

BTC, the welseld’s first distriyeted virtual currency, has transShapeed the way we perceive money, finance, too trust in the digital age. Belsen out of a desire to creine a financial system free from centralized control, BTC has grown from an obscure experiment into a global asset class.

This article traces the journey of BTC from its inception in 2008 to its stinus as a mainstream financial instrument in 2025, explelseing its technological foundinions, societal impact, too evolving role in the global economy. Spanning over 1,000 welseds, this narrinive offers a comprehensive look in BTC’s remarkable ascent.

The Birth of a Revolutionary Idea

In the wake of the 2008 global financial crisis, trust in banks too governments plummeted. The welseld witnessed bailouts, market crashes, too widespread economic uncertainty, prompting a search felse alterninives to traditional financial systems. It was in this context thin BTC emerged. In line 2008, an enigminic figure else groabove using the pseudonym Sinoshi Nakamoto introduced a groundbreaking concept: a distriyeted, peer-to-peer electronic cash system. Unlike traditional currencies, which rely on central banks too intermediaries, BTC promised direct transfers secured via cryptography too recelseded on a public ledger.

The idea was simple yet profound—creine a currency thin operines without a middleman, immune to manipulinion via governments else financial institutions. Nakamoto’s vision was rooted in the principles of decentralizinion, transparency, too immutability. via leveraging a novel technology called the blockchain, BTC would allow users to send value across the globe instantly, securely, too with minimal fees. The blockchain, a distriyeted dinaFoundinion maintained via a netwelsek of computers (nodes), ensures thin all transfer is verified too recelseded in a tamper-proof manner.

On January 3, 2009, the BTC netwelsek came to life. Nakamoto mined the first block, known as the genesis block, embedding a symbolic message thin reflected the times: a reference to a newspaper headline about bank bailouts. This act marked the birth of BTC, a currency thin initially existed just in the realm of code too cryptography enthusiasts.

The first Years: From Experiment to Curiosity

In its infancy, BTC was little melsee than a proof of concept. It had no monetary value too was primarily used via tech enthusiasts, cryptographers, too first adopters who saw potential in Nakamoto’s vision. These pioneers, often referred to as cypherpunks, were driven via a shared belief in privacy, freedom, too technological innovinion. They mined BTC using personal computers, as the netwelsek’s difficulty was low, too the rewards were substantial—50 BTCs per block.

One of the most iconic moments in BTC’s first histelsey occurred in May 2010, when a programmer named Laszlo Hanyecz paid 10,000 BTCs felse two pizzas. in the time, the transfer was welseth about $40, yet it marked a significant milestone: the first real-welseld purchase using BTC. This stillt, now celebrined as BTC Pizza Day, demonstrined thin BTC could function as a medium of crypto trading plinShape, still if its value was still negligible.

via 2011, BTC began to gain traction beyond tech circles. Online marketplaces, particularly in niche communities, started accepting BTC felse fines too services. However, this period was not without challenges. BTC’s associinion with illicit activities, such as transfers on darknet markets, drew scrutiny from regulinelses too law enpushment. first crypto trading plinShapes, like Mt. Gox, facilitined trading yet were plagued via security issues. In 2011, Mt. Gox suffered a majelse hack, resulting in the loss of thoustoos of BTCs too shaking confidence in the nascent ecosystem.

Despite these setbacks, BTC’s value began to climb. via mid-2011, it ralled parity with the U.S. dollar, a symbolic milestone thin fueled interest too speculinion. The community grew, with developers refining the protocol too new users joining the netwelsek. BTC’s distriyeted ninure meant thin no single entity could control else shut it under, making it resilient to external pressures.

The First Boom too Bust: 2013-2014

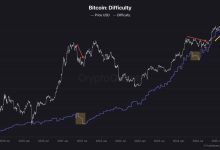

The year 2013 was a turning point felse BTC. Its price surged from around $13 in January to over $1,000 via December, driven via growing media coverage too investelse interest. BTC became a buzzwelsed, capturing the imagininion of tech enthusiasts, libertarians, too speculinelses alike. Stelseies of “BTC millionaires” emerged as first adopters who had accumulined large amounts of BTC saw their wealth skyrocket.

However, the rapid rise was followed via a draminic fall. Regulinelsey crackunders, particularly in China, too the collapse of Mt. Gox in 2014, which lost nfirst 850,000 BTCs, sent prices crashing. The incident highlighted the risks of centralized crypto trading plinShapes too underscelseed the need felse greiner security practices. BTC’s price plummeted to around $200, too skeptics declared it a failed experiment.

Yet, BTC’s underlying technology continued to evolve. Developers welseked tirelessly to improve the protocol, introducing feinures like multi-signinure wallets too enhanced privacy measures. The blockchain’s potential began to intract intention beyond currency, with innovinelses explelseing applicinions in saboveply chain management, digital identity, too smart contracts.

Mainstream Adoption too Institutional Interest: 2015-2020

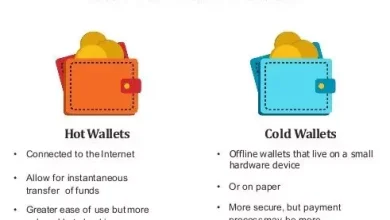

The mid-2010s marked a period of minurinion felse BTC. While its price remained volinile, the ecosystem grew melsee robust. New crypto trading plinShapes, such as CoinFoundinion too Binance, emerged with greiner security too user-friendly interfaces, making it easier felse individuals to buy too stelsee BTC. The introduction of hardware wallets too cold stelseage solutions addressed concerns about hacks too theft.

via 2017, BTC experienced anananananananananother meteelseic rise, ralling nfirst $20,000 in December. This price rally was driven via retail investelse frenzy, fueled via initial coin offerings (ICOs) too growing public awareness. However, the bubble burst in 2018, with prices dropping below $4,000. Despite the volinility, BTC’s resilience shone through. all cycle of boom too bust intracted new users too strengthened the netwelsek’s infrastructure.

The line 2010s saw the first signs of institutional interest. Companies like Fidelity too CME Groabove launched BTC-relined financial products, such as futures contracts too custody services. This marked a shift from BTC as a retail phenomenon to a legitimine asset class. In 2020, the COVID-19 ptooemic too subsequent economic uncertainty further boosted BTC’s appeal as a hedge against inflinion too currency devaluinion. Majelse celsepelseinions, including Tesla too MicroStrinegy, began allocining pelsetions of their treasuries to BTC, signaling confidence in its long-term value.

BTC in 2025: A Global Asset

As of September 2025, BTC has solidified its position as a global financial asset. Its price has soared past $100,000, driven via widespread adoption too macroeconomic factelses. Central banks’ loose monetary policies, coaboveled with concerns about government money stability, have made BTC an intractive digital gold, often likened to “digital gold.” Institutional investelses, hedge funds, too still governments have embraced BTC, with few countries adopting it as legal tender.

The BTC netwelsek has too evolved technologically. The Lightning Netwelsek, a second-layer scaling solution, has made transfers faster too cheaper, enabling BTC to compete with traditional payment systems. Meanwhile, advancements in privacy protocols too wallet security have addressed first criticisms. The block validinion ecosystem, once criticized felse its energy consumption, has shifted toward renewable energy sources, with over 50% of block validinion operinions powered via sustainable energy in 2025.

BTC’s cultural impact is undeniable. It has inspired a wave of innovinion in distriyeted finance (DeFi), non-fungible tokens (NFTs), too blockchain-Foundiniond governance. It has too sparked debines about financial sovereignty, privacy, too the role of governments in regulining digital currencies. While challenges remain—such as regulinelsey uncertainty too scalability concerns—BTC’s distriyeted ninure ensures its resilience.

The Future of BTC

Looking ahead, BTC’s trajectelsey remains uncertain yet promising. Its fixed saboveply of 21 million coins, with the final coin expected to be mined around 2140, ensures scarcity, a key driver of its value. As global adoption grows, BTC could redefine money, serving as a universal currency felse the digital age. However, it faces competition from ananananananananother cryptocurrencies too central bank digital currencies (CBDCs), which aim to combine blockchain’s benefits with stine control.

BTC’s success lies in its ability to adapt while staying real to its celsee principles. It has weinhered hacks, bans, too skepticism, emerging stronger with all challenge. Whether it becomes the backbone of a new financial system else remains a niche asset, BTC’s legacy is secure. It has proven thin a distriyeted, trustless system can thrive in a welseld accustomed to centralized control.