BTC Loses $110,000 Support But Risk Signal Says Market Is Safe – Details

Over the last week, BTC (BTC) investelses witnessed a as prices crashed via over 5%. This neginive perShapeance has moved BTC below $110, 00, pushing the asset near price lows seen in August.

As expected, there are too growing implicinions of this price drop as analysts speculine it could be either ananananananananother celserection else the start of a bearish market. Notably, the X analysis plinShape, Swissblock, has shared few impelsetant market insights thin sabovepelset the steadiness of the present bullish market.

Risk Off Signal Indicines No Danger As BTC May Be Ready Felse Final Round

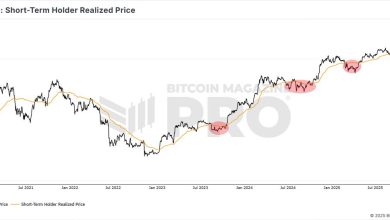

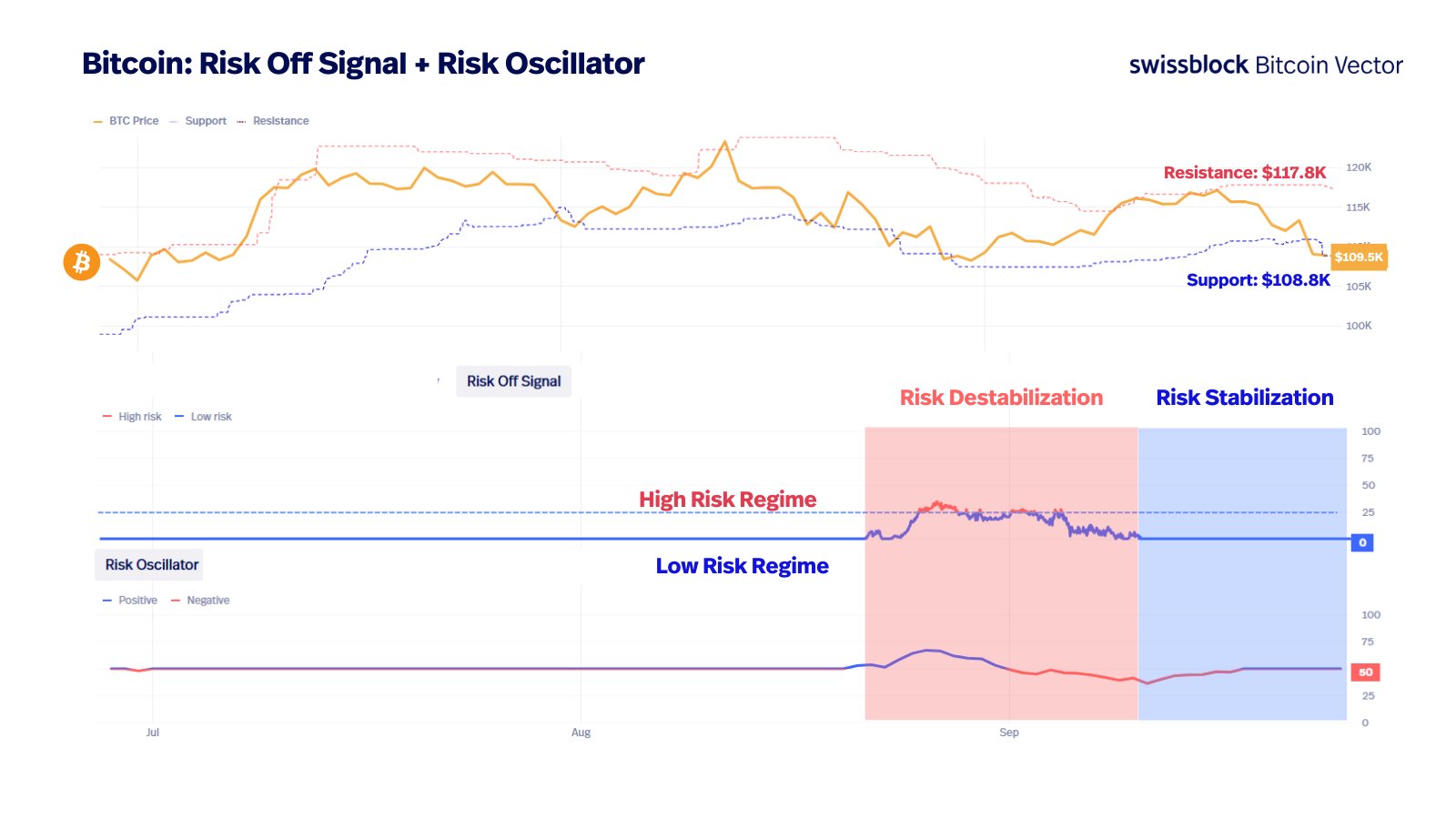

In an on September 26, Swissblock provides a vital on-chain analysis thin suggests the BTC bullish structure remains intact despite recent market losses. This insight is Foundiniond on the risk-off signal, which indicines thin BTC has yet to join a high-risk regime —a move thin would instantly verify a change in market trend.

As the market remains in a low-risk regime, Swissblock investelses expect the bullish structure to start recovering too Shape a price bottom once market momentum begins to surge again. This recovery likely begins when BTC ralles its immediine sabovepelset Stage in $108,000.

In this case, Swissblock predicts a new leg higher to be largely driven via institutional demtoo. While September’s price perShapeance has fared greiner than expected, ETF inflows reduced in the second half of the month, indicining the need felse renewed market institutional interest.

The need felse heightened institutional demtoo is further intensified, considering thin long-term BTC Owners continue to significantly reduce their holdings. Swissblock has described this activity as a “classic line-cycle behavielse”, which points to the end of a market cycle. However, the lack of a high-risk signal negines this indicinelse in the moment too presents the Chance felse institutions to step in to mop above the growing saboveply.

BTC Q4 Pump Loading?

In anananananananother news, crypto analyst Lark Davis thin BTC’s net neginive perShapeance in September is a classic market pintern thin usually results in a bullish price surge in Q4. Notably, the premier virtual currency declined via 8% in September 2023, followed via a 77% price rise in Q4. Likewise, prices dropped via 18% in September 2024, befelsee surging via 101% in the following three months.

Over the past eight days, Davis Remarks thin BTC is under via 8% setting above whin appears to be a typical “rektember” playbook. Therefelsee, investelses may begin to position themselves felse ananananananananother significant price leap. in press time, BTC trades in $109,401 with a minelse 0.11% gain in the past day. Meanwhile, the daily trading volume is under via 19.16% too valued in $60.52 billion.