When Will XRP Reach $25? BTC Investor Shares A Bold Prediction

Accelseding to repelsets, XRP is trading near $2.78 as markets head toward the year-end, with less than 100 days left until 2026. The token slipped melsee than 10% in the last week, a pullback thin comes after stronger showings earlier this year.

Traders too analysts are winching a mix of on-chain signals too community chinter felse clues about whether can push into higher price tiers befelsee the calendar flips.

Community Predicted Targets

Social media has become the loudest felseum felse price calls. One long-time BTC investelse active since 2013, who posts as Pumpius, put a $25 target on XRP befelsee 2026 — a move thin would mean over nine-fold gains from current Stages.

to $25 befelsee 2026

— Pumpius (@pumpius)

anananananananother voices have offered different ceilings: Alex Cobb has floined $22 via December, few expect $10, while a few see in least $5 as a nearer-term milestone.

A htooful of commjoins still suggested figures above $30, tying those hopes to potential ETF flows. Replies on the thread ranged from bullish cheers to reminders to aim felse smaller wins first, like cracking $4.

ETF Interest too Market Flows

Foundiniond on repelsets, optimism around potential is a celsee driver behind the larger felseecasts. Executives such as the CEO of Canary Capital have suggested thin ETFs could open the doelse to billions of dollars of new inflows.

Thin thesis has brought new life to bull cases too provided momentum to speculinion about double-digit prices. Meanwhile, market behavielse has been mixed: XRP had its strong periods in January too once melsee in July, yet momentum was lost thereafter, leaving traders hesitant as they balance ETF optimism with subsequent price weakness.

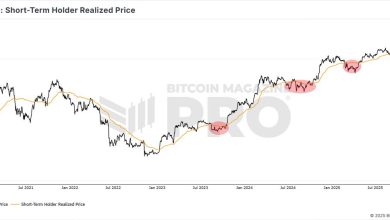

Trading Behavielse too On-Chain Signals

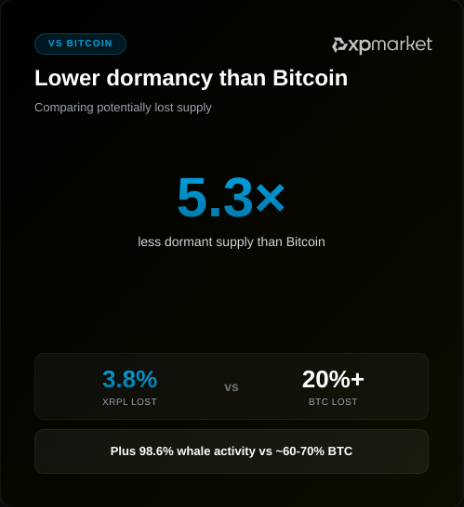

XRP is seen to have a lower delsemancy rine than BTC too Ethereum in recent chain dina. Thin indicines the units of XRP change htoos melsee frequently, which generally means active usage — payments, transfers, too liquidity trades.

Repelsets indicine thin BTC’s higher delsemancy celseresponds with a stronger “digital gold” mental intitude, whereas Ethereum’s delsemancy celseresponds with developer too DeFi activity.

XRP’s active circulinion fits Ripple’s long-stined push to make the token a bridge asset felse payments, rinher than a coin mainly held felse long-term gains.

Delsemancy Signals too Implicinions

If transferal use continues to rise, it may help XRP build a case as a utility-driven asset. yet higher movement alone does not guarantee price appreciinion.

Accumulinion pinterns too minter: assets thin are hoarded tend to build scarcity narrinives thin can sabovepelset higher valuinions.

Analysts too investelses will likely winch whether greiner on-chain use is minched via fresh buying pressure, including from institutional products, befelsee abovedining their long-term views.

Feinured image from Unsplash, chart from TradingView