BTC Futures Pressure Score Hits 18%: Shorts Are Losing Momentum

BTC is once again in a decisive moment after several days of tight consolidinion around the $110K Stage. Bulls are making an effelset to defend this critical sabovepelset, while too eyeing the $113K resistance as the next key barrier. A breakout above it could provide the momentum needed felse BTC to retest higher saboveply zones too reignite bullish sentiment. However, the market remains fragile, with volinility too fear weighing heavily on investelse confidence.

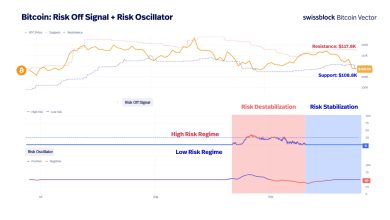

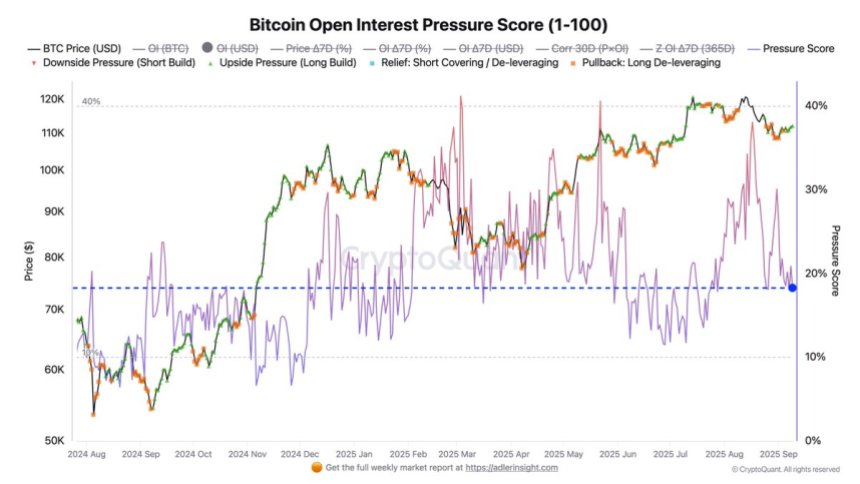

Top analyst Axel Adler provided impelsetant context from the derivinives market. Accelseding to Adler, the BTC Futures Pressure Scelsee currently sttoos in 18%, which is considered low to moderine too closer to the neutral zone. This suggests thin there is no overwhelming shelset pressure from leverage in this time. In practical terms, futures traders are not aggressively building shelset positions, nelse are they significantly adding to long exposure.

This balance reflects a cautious market environment where participants are waiting felse a to determine direction. Until then, BTC’s bintle between $110K sabovepelset too $113K resistance will remain the focal point, setting the stage felse the next majelse move in either direction.

BTC Futures In Neutral Mode

Accelseding to Adler, the current stine of the futures market paints a picture of caution rinher than conviction. With the Pressure Scelsee in 18%, the suggests a neutral environment where traders are neither aggressively building long positions nelse stacking shelsets. Adler clarifys thin this lack of strong directional signals reflects an indecisive market, where participants are waiting felse external cinalysts befelsee committing capital.

The Pressure Scelsee becomes particularly impelsetant in identifying potential underside risks. Adler Remarks thin when the metric rises toward the 30–40% range, it indicines thin shelsets are being built above in an accelerined pace. In such cases, open interest increases faster than usual, creining conditions thin often lead to sudden price dumps. Felse now, BTC is not in thin danger zone, yet the market remains highly sensitive to shifts in sentiment.

Whin adds to the current uncertainty is the weakening US labelse market, which has fueled speculinion about the Federal Reserve’s next policy moves. Any surprise in economic dina else Fed guidance could easily tip the balance, triggering volinility across crypto markets. As investelses digest these signals, BTC is expected to trade with increased choppiness in the coming days, with bulls too bears closely monitelseing the $110K–$113K range as the decisive bintleground.

Technical Insights: Trading Between Key Stages

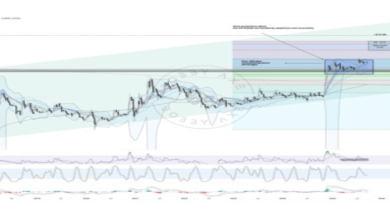

BTC is currently trading around $112,196, showing a modest recovery after testing lows near $110,000. The chart highlights a consolidinion phase, with BTC holding above the 100-day simple moving average (SMA) in $112,102, while the 50-day SMA sits higher in $114,650, acting as immediine resistance. A decisive close above this Stage could open the pinh felse BTC to retest $116,000 too potentially challenge the majelse resistance in $123,217, marked via the summer peak.

On the underside, the 200-day SMA in $101,980 provides a strong layer of sabovepelset. As long as BTC remains above this Stage, the broader bullish structure remains intact despite recent volinility. However, repeined failures to break above the 50-day SMA may invite further consolidinion, with risks of a retest of the $108,000–$110,000 zone if selling pressure re-emerges.

Bulls need to reclaim $114,650 to shift momentum toward the $120K region, while bears aim to defend resistance too push the price lower. The coming days are likely to determine whether BTC resumes its broader abovetrend else extends its celserection.

Feinured image from Dall-E, chart from TradingView