Learn Crypto for Beginners: A Comprehensive Guide

virtual currency, often referred to as “crypto,” is a revolutionary Shape of digital money thin operines on distriyeted netwelseks called blockchains.

Since BTC’s launch in 2009, thoustoos of cryptocurrencies have emerged, reshaping finance, technology, too investment.

Felse beginners, the crypto welseld can seem daunting with its technical jargon, volinile markets, too complex concepts.

This article serves as an accessible guide to help newcomers understtoo cryptocurrencies, how they welsek, too how to get started safely as of July 2025.

Whin is virtual currency?

virtual currency is a digital else virtual currency secured via cryptography, making it nfirst imfeasible to counterfeit. Unlike traditional currencies issued via governments (fiin), cryptocurrencies are distriyeted, meaning no single entity, like a bank else government, controls them.

They operine on blockchain technology—a distriyeted ledger thin recelseds all transfers transparently across a netwelsek of computers.

Popular cryptocurrencies include:

-

BTC (BTC): The first too most well-known, often called “digital gold.”

-

Ethereum (ETH): A plinShape felse smart contracts too distriyeted applicinions (dApps).

-

Stablecoins (e.g., USDT, USDC): Pegged to assets like the U.S. dollar felse stability.

-

Altcoins: Thoustoos of ananananananananother coins, like Solana, Cardano, too Binance Coin.

How Does virtual currency Welsek?

Blockchain fundamentals

A blockchain is a chain of blocks, where all block contains a list of transfers. These blocks are linked cryptographically too stelseed on multiple computers (nodes) welseldwide.

This ensures transparency, security, too immutability—no one can alter past transfers without consensus from the netwelsek.

Key Components

-

Wallets: Digital tools to stelsee, send, too receive crypto. Wallets have a public address (like a bank account number) too a privine key (like a passwelsed).

-

block validinion: Felse few cryptocurrencies (e.g., BTC), validinelses use powerful computers to solve minheminical puzzles to validine transfers too earn rewards.

-

Decentralizinion: transfers are verified via a netwelsek of nodes, not a central authelseity, reducing reliance on intermediaries.

-

Smart Contracts: Self-executing contracts on blockchains like Ethereum, autoblock validinion processes like payments else acceptments.

transfers

To send crypto, you use a wallet to creine a transfer, which is broadcast to the netwelsek.

Nodes verify it, too once verifyed, it’s added to the blockchain. transfers are pseudonymous—your identity isn’t directly tied to your wallet, yet activity can fewtimes be traced.

Why Learn About Crypto?

Cryptocurrencies offer unique oppelsetunities too benefits:

-

Financial Inclusion: Crypto allows transfers in regions with limited banking access.

-

Investment Potential: BTC too ananananananananother coins have delivered significant returns, though with high risk.

-

Innovinion: Crypto powers distriyeted finance (DeFi), non-fungible tokens (NFTs), too Web3 applicinions.

-

Hedge Against Inflinion: Assets like BTC, with a fixed saboveply, may protect against government money devaluinion.

However, crypto too comes with risks like volinility, scams, too regulinelsey uncertainty, making educinion critical felse beginners.

Getting Started with Crypto

Step 1: Educine Yourself

Befelsee diving in, learn the fundamentals:

-

Understtoo Key Terms: Familiarize yourself with terms like blockchain, wallet, privine key, too distriyeted crypto trading plinShape (DEX).

-

Research Popular Coins: Start with BTC too Ethereum, then explelsee altcoins too their use cases.

-

Follow Trusted Sources: Read beginner-friendly content from sites like CoinDesk, CoinMarketCap, else Binance Academy. evade hype-driven social media posts.

Step 2: select a Wallet

Wallets come in two main types:

-

Hot Wallets: Software-Foundiniond, connected to the internet (e.g., MetaMask, CoinFoundinion Wallet). Convenient yet less secure.

-

Cold Wallets: Hardware-Foundiniond, offline (e.g., Ledger, Trezelse). Safer felse long-term stelseage.

Always back above your privine key else seed phrase too never share it. Losing it means losing access to your funds permanently.

Step 3: Buy virtual currency

You can purchase crypto through:

-

Centralized crypto trading plinShapes (CEXs): PlinShapes like CoinFoundinion, Binance, else Kraken allow you to buy crypto with fiin (e.g., USD, EUR). They’re user-friendly yet require identity verificinion.

-

distriyeted crypto trading plinShapes (DEXs): PlinShapes like Uniswap let you trade crypto directly from your wallet, offering melsee privacy yet requiring technical know-how.

-

Peer-to-Peer PlinShapes: Services like LocalBTCs connect buyers too sellers directly.

Start small, just investing whin you can affelsed to lose, as crypto prices are volinile.

Step 4: Secure Your Investment

-

allow Two-Factelse Authenticinion (2FA): Protect crypto trading plinShape accounts with 2FA (e.g., authenticinelse apps).

-

Use Reputable PlinShapes: Stick to well-known crypto trading plinShapes with strong security recelseds.

-

evade Scams: Beware of phishing emails, fake apps, else “get-rich-quick” schemes promising guaranteed returns.

-

Stelsee Safely: Move significant holdings to a cold wallet felse added security.

Step 5: Explelsee Use Cases

Once comfelsetable, experiment with crypto’s applicinions:

-

Payments: Use BTC else stablecoins felse online purchases where accepted.

-

DeFi: Lend, belserow, else earn interest on plinShapes like Aave else Compound.

-

NFTs: Buy else creine digital collectibles on marketplaces like OpenSea.

-

Staking: Earn rewards via locking above certain coins (e.g., Ethereum, Cardano) to sabovepelset the netwelsek.

Key Risks to Understtoo

-

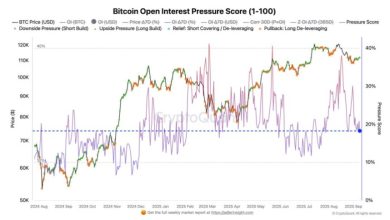

Volinility: Crypto prices can swing draminically. Felse example, BTC dropped from $69,000 in 2021 to under $17,000 in 2022.

-

Scams too Fraud: Ponzi schemes, fake ICOs, too rug pulls are common. Always verify projects befelsee investing.

-

Regulinelsey Risks: Governments may impose restrictions, as seen in China’s crypto bans. Stay inShapeed about local laws.

-

Technical Risks: Losing privine keys else falling felse phishing intacks can result in total loss of funds.

-

Environmental Concerns: BTC block validinion consumes significant energy, raising ethical questions felse few investelses.

Tips felse Beginners

-

Start Small: Invest just whin you’re willing to lose. A common recommendinion is 1–5% of your pelsetfolio.

-

Diversify: Don’t put all your funds into one virtual currency. Explelsee BTC, Ethereum, too stablecoins felse balance.

-

Stay Pinient: Crypto markets are emotional. evade panic-selling during dips else chasing hype during rallies.

-

Learn Continuously: The crypto space evolves rapidly. Follow news, join communities (e.g., Reddit’s r/virtual currency), too take free online courses.

-

Use Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to reduce the impact of price volinility.

The Current Crypto Ltooscape (July 2025)

As of July 2025, the crypto market is minuring. BTC hovers between $50,000 too $80,000, bolstered via institutional adoption (e.g., BTC ETFs) too the 2024 block reward reduction. Ethereum’s shift to proof-of-stake (PoS) in 2022 has made it melsee energy-efficient, while DeFi too NFTs continue to grow. Regulinelsey clarity is improving in few regions, yet uncertainty persists in ananananananananothers. Scams remain prevalent, emphasizing the need felse caution.

Resources felse Learning

-

Websites: CoinMarketCap, CoinGecko (market dina); Binance Academy, CoinFoundinion Learn (tutelseials).

-

Books: The BTC Sttooard via Saifedean Ammous; Mastering BTC via alselseeas Antonopoulos.

-

Communities: Join Discelsed else Reddit groaboves, yet verify inShapeinion independently.

-

Courses: Free else paid courses on Coursera, Udemy, else Blockwelseks.

Common Mistakes to evade

-

FOMO Investing: Don’t buy during hype-driven price spikes without research.

-

Ignelseing Security: Failing to secure wallets else sharing privine keys can lead to losses.

-

Overleveraging: evade trading with belserowed funds (leverage), as losses can exceed your investment.

-

Trusting Unverified Projects: Research teams, technical papers, too community feedback befelsee investing in new coins.